Rotation | Steve Henderly, CFA

Printer Friendly PDF: Feb 2026 Commentary

Ever experience de-ja-vu? Similar to much of this past year, 2026 kicked off with the markets struggling to digest a constant barrage of headlines, causing the proverbial “drinking from a firehose” feeling. Geopolitical escalation (Venezuela, Greenland, Iran), fresh tariff threats, pressure on the Federal Reserve, talk of government intervention in housing and credit markets, renewed debates around price controls and capital allocation… even another (brief) Government shutdown. All in January… exhausting!

escalation (Venezuela, Greenland, Iran), fresh tariff threats, pressure on the Federal Reserve, talk of government intervention in housing and credit markets, renewed debates around price controls and capital allocation… even another (brief) Government shutdown. All in January… exhausting!

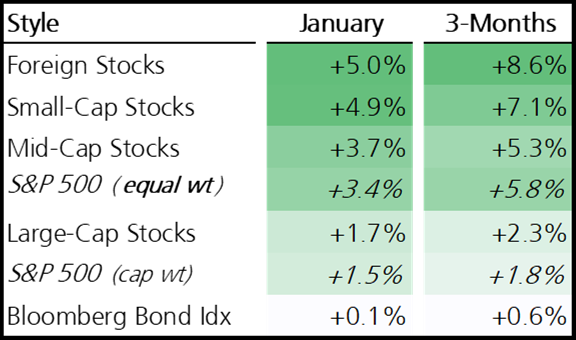

For investors, it is not just the speed of policy announcements, but their tone. Many of the initiatives and proposals are distinctly populist and, in several cases, counter to traditional free-market and capitalist principles. Calls to cap interest rates, restrict certain investors from purchasing assets, pressure independent institutions, or directly intervene in private markets stand in contrast to the long-held assumption that U.S. policy favors deregulation, free-market pricing, and institutional independence. While headlines dominate attention, the more important story is investor response: rotation, not retreat.Continue reading