No Brakes & More Gas! | Steve Henderly, CFA

Printer Friendly PDF: Link to PDF Version

The third quarter provided big encouragement for long-term investors, defying persistent anxiety about the economy, politics, and more. Stocks and client portfolios alike enjoyed three consecutive months of decidedly positive performance. Let’s review:

“Christmas in July” – In July, markets received the gifts investors appeared to long for: passage by Congress of the so-called “OBBB” tax and spending bill making permanent tax cuts passed in 2017 and unlocking immediate expensing for business investment. Clarity on taxes relieved one of the biggest overhangs from earlier in 2025. Simultaneously, trade negotiations advanced. Framework deals were struck with the EU, Japan, UK, South Korea, and others which collectively cover over 70% of U.S. trade. Tariffs many feared would be punitive proved to be more moderate, easing pressures on global growth expectations. Those “gifts” were the easiest source to attribute 11 new record highs and +2.2% advance enjoyed by the S&P500 during July.

“All Gas, No Brakes” was our market narrative for August as investors appeared to lean fully into momentum and interest rate cut anticipation. A surprisingly weak jobs report in early August, showing just ~75,000 jobs added in the month prior PLUS large downward revisions to prior employment figures reinforced market views that the Fed was falling behind and putting the economy at unnecessary risk. As is often the case for investing, weak economic data was viewed through rose colored glasses on the belief that a more accommodative posture could be resumed by the Fed. Chair Powell’s Jackson Hole comments fortified those perspectives and the probability of a September cut soared. Despite underlying caution with respect to what is historically a challenging seasonal stretch, the S&P gained +1.9%, set new highs, and participation broadened (70% of constituents above their 200-day averages). On the fundamentals side, S&P 500 revenue expanded ~6.3% – the strongest in over a year – dampening fears that tariffs would derail earnings.

September gave us “More Gas!” In a month historically seen as the most challenging of the year from a seasonal perspective, it was the Fed that maintained investor attention and officially delivered its first rate cut since pausing at the end of 2024. The rate cut as well as comments from Fed governors seem to officially return policy to a more accommodative trajectory, citing economic data that growth conditions are sufficiently soft to justify lowering rates. This helped the traditional size-weighted S&P500 log 8 additional record highs during the month, although beneath the surface of the go-go technology sector, the ascent was decidedly more tempered with the average stock in the 500 company index climbing just 1%.

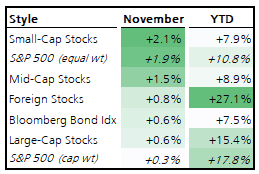

The market enters the 4Q expecting two more 0.25% interest rate cuts before year-end and two to three more in 2026. As alluded to above, market performance during the 3Q remained strongest among the Magnificent 7 and tech-sector stocks. This leadership is disconcerting for those – like us – who see that area of the market as priced for perfection and too heavily concentrated. We are encouraged to observe small-cap stocks finally record a fresh all-time high in late-September, the first new high for small cap stocks in over four years. This breakout underscores how lower interest rates are generally believed to more greatly benefit smaller companies and everyday consumers.

Read on as we dig deeper into the factors that we believe will most influence the market over the remainder of the year.

Continue reading→

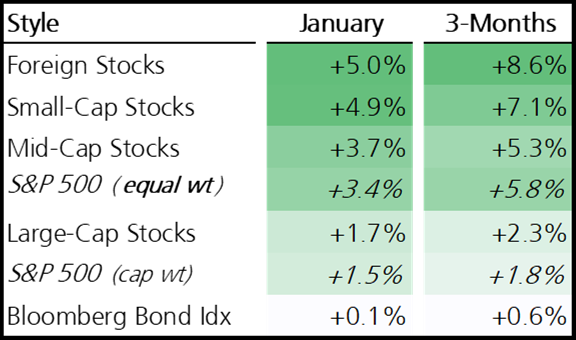

escalation (Venezuela, Greenland, Iran), fresh tariff threats, pressure on the Federal Reserve, talk of government intervention in housing and credit markets, renewed debates around price controls and capital allocation… even another (brief) Government shutdown. All in January… exhausting!

escalation (Venezuela, Greenland, Iran), fresh tariff threats, pressure on the Federal Reserve, talk of government intervention in housing and credit markets, renewed debates around price controls and capital allocation… even another (brief) Government shutdown. All in January… exhausting! Happy Thanksgiving! Ready or not, another holiday season is upon us. ‘Tis the season for gathering with family and friends, eating too much food, and if your schedule permits, the consumption of a few classic Christmas movies. Trading Places (1983), a comedy starring Eddie Murphy and Dan Aykroyd, may not be the first movie that comes to mind, but it is set during the Christmas season (and really funny, but not kid friendly!). Trading Places is a comedy built around a cruel social experiment conducted by the wealthy Duke brothers, who wagered they can swap the lives of two men to prove whether success is a product of nature or nurture. Louis Winthorpe III, a privileged, elitist commodities broker, is framed for crimes to destroy his life, while Billy Ray Valentine, a street hustler struggling to get by, is elevated into Winthorpe’s job, home, and social circle. As the two men adapt to their reversed circumstances, they eventually uncover the scheme, team up, and turn the tables on the Dukes by manipulating the commodity market; outsmarting the system that manipulated them and destroying the Duke brothers’ empire.

Happy Thanksgiving! Ready or not, another holiday season is upon us. ‘Tis the season for gathering with family and friends, eating too much food, and if your schedule permits, the consumption of a few classic Christmas movies. Trading Places (1983), a comedy starring Eddie Murphy and Dan Aykroyd, may not be the first movie that comes to mind, but it is set during the Christmas season (and really funny, but not kid friendly!). Trading Places is a comedy built around a cruel social experiment conducted by the wealthy Duke brothers, who wagered they can swap the lives of two men to prove whether success is a product of nature or nurture. Louis Winthorpe III, a privileged, elitist commodities broker, is framed for crimes to destroy his life, while Billy Ray Valentine, a street hustler struggling to get by, is elevated into Winthorpe’s job, home, and social circle. As the two men adapt to their reversed circumstances, they eventually uncover the scheme, team up, and turn the tables on the Dukes by manipulating the commodity market; outsmarting the system that manipulated them and destroying the Duke brothers’ empire.