In 1970, baseball great Ted Williams was quoted saying “a good hitter can hit a pitch that is over the plate three times better than a great hitter with a questionable ball in a tough spot.” And second, “Obviously you don’t just ‘guess’ curve or ‘guess’ fastball – you work with a frame of reference, you learn what you might expect in certain instances, and you go from there.” Perhaps it’s the coaching of my two sons’ baseball teams, but isn’t it interesting the parallels between sports and investing? Successful investors strive to identify “fat pitches” to hit instead of chasing bad ones. If playing basketball, it’s taking the “lay up” instead of shooting for 3-points. Why take increased risks by hitting pitches out of the strike zone, or shooting for 3-points? Why not seek the “fat pitch” or “lay-up” areas of the market that appear ripe for accelerating performance? After many years of repeated leadership, the most expensive areas of the market (mega-cap tech stocks) seem overdue for a break. They are priced to perfection, and thereby risky. Should you swing at the risky-to-hit pitch regardless of the count or game situation?

Throughout 2023 and frankly, most of the last decade, much was written on the concentration of market performance; a handful of mega-size company stocks masked the fact that most of the investable universe fared less robustly than indexes such as the S&P500, Dow Jones, and Nasdaq otherwise suggest. The divergence last year reached a climax in late-October as the Magnificent 7 names were up more than 50% at that point, while the other 493 companies in the S&P500 were slightly negative. After years of outperformance and seeming to be the market’s answer regardless of the game’s situation or pitch count (interest rates, growth vs. recession, etc.), these few stocks are extraordinarily expensive relative to 20-year valuation averages.

Other areas of the market appear more attractively valued. During the final two months of 2023 the market appeared that it was beginning to recognize these dynamics. Performance broadened with mid and smaller-size companies (also international) outperforming; some are calling it a “pivot party”. This party advanced because declining inflation rates suggested to investors that the Federal Reserve’s rate hikes were done, and easier monetary policy could begin to arrive in 2024. This provided BIG encouragement for performance of portfolios.

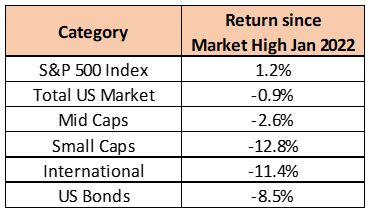

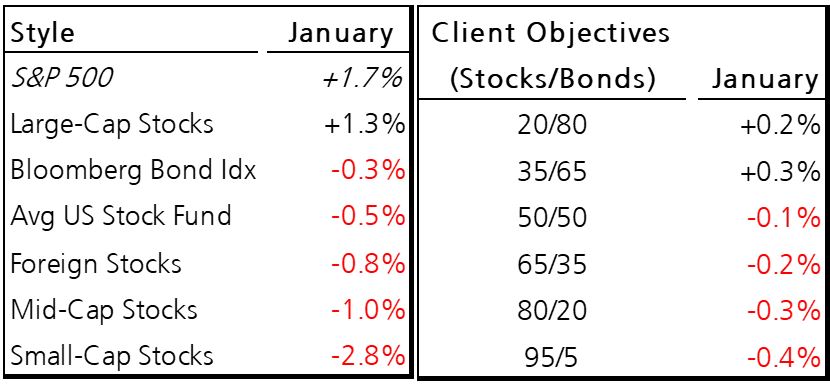

Not so fast. Excitement can be short-lived due to many factors. A Wall Street Journal story on January 19th included this statement, “The S&P500 looks poised to set another high-water mark. Tech shares are leading the charge…” But while the S&P500 recently achieved new highs, most investors with diversified portfolios were unable to claim the same victory (unless adding new money). It can be frustrating! As seen via the data to the right, full recovery has NOT occurred for most of the market. This is true for both stocks and bonds. How easy it can be to consider “throwing in the towel” on a diversified portfolio after seeing a new year once again favoring a few expensive stocks.

“The S&P500 looks poised to set another high-water mark. Tech shares are leading the charge…” But while the S&P500 recently achieved new highs, most investors with diversified portfolios were unable to claim the same victory (unless adding new money). It can be frustrating! As seen via the data to the right, full recovery has NOT occurred for most of the market. This is true for both stocks and bonds. How easy it can be to consider “throwing in the towel” on a diversified portfolio after seeing a new year once again favoring a few expensive stocks.

Investing based on fundamentals will ultimately achieve success. More attractive valuations provide the opportunity to outperform over time with the benefit of reduced risk otherwise inherent when buying overvalued assets. Markets can often remain “irrational” (ignoring fundamentals) for extended periods due to emotional investors that chase past performance, assuming that similar experiences will continue. Stocks priced for perfection are vulnerable to larger drawdowns when there is any hint of slowdown – as seen with the recent action by Apple, Tesla and Google. It’s like swinging after a “bad pitch because you are behind in count.” You can look silly very fast. Could these recent cracks be an early sign of normalization in the market? For those interested, please read this timely article from the Wall Street Journal (link).

Looking forward…. market sentiment is probably a little too rosy in the early days of 2024, and thus a bit of a liability. It is difficult to positively surprise market expectations when optimism is already high. A year ago, this was almost the opposite amid a pessimistic and cautious attitude. But today, expectations for future Fed rate cuts, economic resilience, and further reductions to inflation rates are providing tailwinds for the market. Interest rates probably experienced their high. Yet as we reviewed in November, the “Last Mile” toward normalization of inflation is unlikely to be smooth or easy. If employment continues to remain strong, the Fed will desire to see further reductions to the inflation rate before lowering interest rates. They will remain non-committal to state when rate cuts will start. If Congress institutes some election year tax cuts and spending, then the Fed’s mission relating to inflation could be challenged; cutting rates too soon could re-ignite inflation and waiting too long could lead to slower economic growth. Policy transitions are challenging; they often create uncertainty and higher market volatility.

We are already aware of politics for 2024 – a presidential election year. Market action is historically positive during presidential re-election years. When a sitting president is up for re-election, various economic levers are “pulled” to keep economic growth positive and delay or avoid a recession (albeit the USA already sports high deficits which place greater attention on government spending). Political ‘juicing’ of the economy via tax cuts and spending creates market upside opportunity, but with uncertainty.

Back in the batter’s box, be prepared for some market curve balls. Keep an eye out for the “fat pitch” which is far easier to hit for success. In other words, investing is more about doing simple things repeatedly; don’t get cute and fancy. It’s best to be disciplined and follow a repeatable successful process. If you are feeling perplexed, we recommend “When in doubt, zoom out”. Assess whether your investments are doing what they should over time… offsetting the effects of inflation and advancing you toward your long-term financial goals. There will be times in that journey where returns run faster than expected, and others slower. Time is your greatest ally; keeping time on your side will produce success.

“The trick in any field – from finance to careers to relationships – is being able to survive the short-run problem so you can stick around long enough to enjoy the long-term growth. Save like a pessimist and invest like an optimist. Plan like a pessimist and dream like an optimist.” (Morgan Housel, Same as Ever).

Steve Henderly, CFA | Nvest Wealth Strategies®

Printer Friendly PDF: Feb 2024 Commentary