How long can you hold your breath? Can you hold it longer under water, or does the anxiousness of being submerged lessen your ability? Taking this analogy into the economic world of interest rates…when interest rates are at levels above inflation, defined as “positive real interest rates,” it’s akin to holding your breath underwater. Building further on this idea, are Artificial Intelligence (AI) stocks like an oxygen tank providing the financial markets the ability to keep swimming? How long can this condition last; how long will the oxygen tank allow us to remain underwater?

“As the calendar flips into March, investors find themselves in a precarious position – like a diver submerged in deep waters. The markets, fueled by optimism and AI-driven momentum, surged in recent weeks, but lurking beneath the surface lies the specter of rising real interest rates. Let’s explore this delicate balance.”

You might find it interesting that the above section in italics is actually an excerpt from a longer commentary I generated using AI by providing the underwater and oxygen tank analogies as prompts. Given all the buzz over AI in recent months, it was fascinating to review the full output!! If AI can perform sophisticated tasks, more economic activity can occur with the same or less input. Similar to past technological breakthroughs (automobile, computer, cellphone, etc.), this productivity theme appears to be allowing investors to look past some other big sources of uncertainty as we continue to move further into 2024. But these opening thoughts need to transition, because the remainder of AI generated content did not provide a useful explanation to the analogy of holding your breath underwater, or other market specifics. So we’ll take it from here…

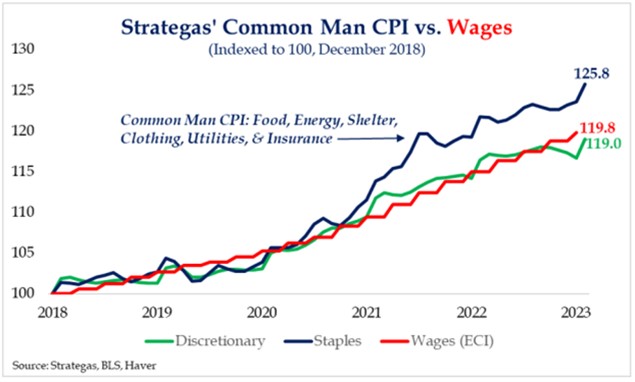

While AI-led stock market enthusiasm characterized the 2nd half of February, the early part of the month felt more stressful. Early in February, higher than expected inflation data forced investors to reduce their hopes of a shift to more accommodative Fed monetary policy. Most consumers probably don’t need government data to tell them that inflation of necessities – from food and gasoline to insurance, clothing, and utilities prices – are creeping up again. A key research source, Strategas recently created an index of ‘Common Man’ Inflation; it reflects strain felt by consumers in recent months. This keeps the Fed in a challenging spot.

That’s because inflation, while ticking up in recent data, is much improved from its peak last summer. The Fed officially paused/stopped raising rates 6 months ago, but real rates (after subtracting inflation) are continuing to creep higher if/as inflation continues to soften. Real interest rates are important to the economy because they reflect the cost of borrowing money. When money is expensive the economy (and stocks) can languish, but effects are usually revealed with a long and variable lag. Thus, the ultimate impact of rates in restrictive territory remains uncertain about when economic activity may soften. It’s like holding your breath underwater. You can do it for a time, but it becomes riskier the longer you do it. If the Fed cannot or won’t ease yet, the markets may become unsettled during the wait (uncertainty).

This reinforces our expectation that the Fed will not be able to begin cutting rates as much or as quickly as the consensus believed in recent months. Historically, inflation does not just disappear without some waves (up, down, up). The Fed does not desire to risk a repeat of stop-go inflation experienced in the ‘70s. That’s good, and historically markets do fine when the Fed is on pause. But we must live with continued uncertainty about how the economy will continue to perform against the weight of higher real interest rates and sticky inflation. Then, when you add the Presidential Election to the mix, it seems improbable that even AI can continue to float the market without some interruptions.

We suspect that recent AI-growth inspired enthusiasm is due for a breather. Market sentiment is elevated – bullish on a market where the list of companies making new highs is still relatively narrow and still “underwater” from two years ago. That suggests keeping a focus on fundamentals – key inflation data, interest rate action, and economic growth. Hints of economic slowdown could alter investor bullishness. The Fed will be closely watched for clues about their policy focus; and government fiscal policy continues to raise concern due to deficit spending and financing it. High real interest rates start to weigh on government and markets.

In conclusion, 2024 is starting well. AI is inspiring the investment community to envision big productivity gains in the coming years. We are optimistic for 2024 but highlight the tug of war investors are experiencing. History reveals the long-term investors’ journey is rarely without choppy waters that create uncertainty in the short-term. To answer our opening question: positive real rates keep the economy holding its breath underwater, but AI is so far appearing to be an oxygen tank, buying time for the Fed to keep rates steady and thereby allow inflation to retreat further. That may help make the full year a positive experience even if we are due to encounter some choppy waves along the way.

Other Portfolio Notes:

We recently rebalanced client accounts, recognizing a number of market areas were running at dramatically different speeds throughout 2023. This is an important part of portfolio risk management. One interesting development so far in ’24: international is behaving nicely, including the Japanese market which is surging to new all-time highs with strong momentum. The last time Japan achieved all-time highs was the same year Joe Montana and Magic Johnson were their sport’s respective MVPs. It’s also an intriguing and non-consensus area, being all but forgotten since 1990. We believe there remains significant upside (with favorable valuations) after years of being left for dead for 30+ years.

Steve Henderly, CFA | Nvest Wealth Strategies®

Printer Friendly PDF: March 2024 Commentary