We are encouraged by the beginning of Spring weather, and hope this note finds you the same. For investors, both stocks and bonds finished the 1Q with gains, but it was anything but easy. Stocks vaulted higher in January on renewed hope from investors that the Fed just might stick the proverbial ‘soft landing’ for the economy and be able to end its rate hiking campaign. But in February economic data remained just too-hot and was again viewed as “bad”, counter to the idea the Fed could stop or even slow its tightening, sending the markets quickly back down. As the bond market quickly priced-in additional rate hikes to come from the Fed, two “weak-link” banks broke in early March and ushered in several weeks of fear about the viability of the global banking system. Quick steps taken by policy makers seemed to calm those worries and permitted stocks to claw back into the black by month-end.

But where do we go from here, and what should investors make of recent market performance and confusing sector leadership? This quarter we offer the following brief articles:

- “Who’s Driving?” – Is it stocks or bonds that are most driving financial market action? We review the key drivers of market action during the 1Q, and how with the recent banking sector stress so greatly complicates the Fed’s decisions.

- “Kindness of Strangers” – For at least the last 12 years, companies (and consumers) benefited from virtually free money lent by complete strangers (depositors earning zero). That era is now over, and the kindness seems to now favor depositors/savers. But are these higher yields on cash as good as they seem?

- “Are My Assets Safe?” – Our personal finance discussion this quarter focuses on recent financial system stress, and addresses the question of how Schwab is weathering this environment as an investment custodian.

Click here for the Printer-friendly PDF version including custom benchmarking and fund data.

We hope these updates are helpful, especially given how noisy the current environment remains. Please do not hesitate to call or email with questions, or to coordinate a time to visit together.

WHO’S DRIVING?

Bill Henderly, CFA, Nvest Wealth Strategies, Inc.

Interest rates and bonds are driving the financial markets; stocks are along for the ride. As the Federal Reserve continues to battle high inflation by raising rates and tightening money supply, its actions are driving bond market action. Rate hikes increase the cost of borrowing for both businesses and consumers. Thus, stocks are being “carried along” because policy change is significant and creating uncertainty. The greatest items of investor uncertainty relate to when will the Fed conclude tightening actions, and how much economic damage will their actions cause (ie: recession). This translates into volatility – up/down market action that also amplifies investor worry, on full display during 1Q2023.

Let’s briefly review the sequence and events of the first quarter. The US economy started out 2023 with momentum despite the Fed’s aggressive tightening during 2022. Market participants were hopeful these Fed actions would be enough to curb inflation. January financial market performance was exciting and strong, and investors were encouraged. As February arrived, economic news was too good (unemployment at all-time lows); “good news” was deemed “bad news” on the belief the Fed would be forced to continue raising rates even as bonds/stocks struggled. In general, the end of tightening was uncertain. As March arrived with signs of economic slowing, bonds and stocks attempted to rebound, until… two banks failed as many large tech-sector and startup-company depositors quickly pulled money (bank run). These bank failures elevated public worry that even short term money may not be safe. Stocks managed to recover by the end of March following the Treasury boosting cash reserves in the banking system. Volatility creates investor uncertainty, particularly when the Fed is raising interest rates aggressively to battle high inflation.

Recall, monetary policy affects the economy with a 6 to 9 month lag. Peak inflation likely occurred last summer at over +9%. Recent stats show it improved at 6% annualized, but it will likely take longer for inflation to recede toward a level of 2-3% as full employment (wages) will keep inflation sticky. Monetary policy often reveals “weak links in the chain” as a key business sector struggles (ie: two bank failures in March). Whenever the Fed embarks on tightening its policy, financial risk increases because excessive debt levels become a burden to repay. At some point, weak entities get exposed and fail (default); the “weak link” breaks.

Despite banking system strains in March, the Fed again raised interest rates by 0.25%; but that was its smallest rate increase since beginning this hiking campaign last year. Was this rate hike to 4.75-5.0% the last? Could the shock to the banking system in March from two bank failures (SVB and Signature Bank) cause the Fed to stop or pause, or be very close to the last hike?

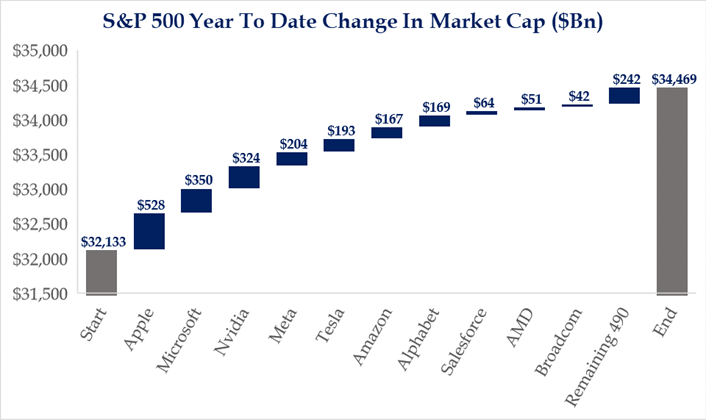

Both stocks and bonds concluded 1Q with gains albeit much reduced from the strong returns enjoyed in January. Client portfolios trailed market indexes as focus shifted to newly defined “safe” assets.  The recent definition of “safe”: includes money market funds and a few big technology stocks (10 names accounted for 90% of the gains – a top-heavy performance experience that is unhealthy). These stocks were beat up in 2022, but are currently viewed as “defensive havens” if a recession occurs. The markets often amaze investors as they shift this way and that – value and dividend-paying stocks worked well during the bear market slide, but now pause as old leaders (viewed as “safe havens”) are rebooted during 1Q. Be careful because the financial markets still reside in the bear trend; there is not robust broad participation to predict the beginning of a new bull market.

The recent definition of “safe”: includes money market funds and a few big technology stocks (10 names accounted for 90% of the gains – a top-heavy performance experience that is unhealthy). These stocks were beat up in 2022, but are currently viewed as “defensive havens” if a recession occurs. The markets often amaze investors as they shift this way and that – value and dividend-paying stocks worked well during the bear market slide, but now pause as old leaders (viewed as “safe havens”) are rebooted during 1Q. Be careful because the financial markets still reside in the bear trend; there is not robust broad participation to predict the beginning of a new bull market.

The Fed finds itself in a challenging spot – continuing its tightening policy to fight inflation while needing to ease and thereby improve public confidence in banks. Two recent bank failures create the challenge. Another new challenge is just arriving. OPEC+ (includes Russia with its economic sanctions resulting from its invasion of Ukraine), announced additional oil supply cuts. Supply cuts are inflationary; they will raise the price of energy and slow economic growth. This action by Russia (OPEC+) is economic warfare. It seems purposefully announced at a tough time for the USA, the Fed, and western allies.

What does this suggest for investing client portfolios? Simply put, “go slow” but keep investing. The OPEC+ announcement suggests, to me, that dividend payers and short-duration assets should reclaim leadership and bounce back; old leaders (new “safe”) that were recently “rebooted” will surrender their recent lead. Bear markets evaporate risk and reveal new market leaders. Further, “Experience teaches the best buying opportunity in long bonds presents itself when the yield curve is inverted” (from George Soros’ book, “The Alchemy of Finance”). Current rates are attractive compared to the past 10+ years. Be careful though to invest in short to intermediate higher quality bonds that comply with your investment time horizon and purpose. Long maturity bonds are much more risky than short/intermediate bonds. Bonds and cash do not battle inflation well over time; they struggle to provide real return. Always focus on marketability, quality and time horizon when owning bonds. Both offer attractive diversification benefits again because current yields exist.

KINDNESS OF STRANGERS

Twelve years of easy money and available credit are over; probably for quite some time. During that time, interest rates were nil to zero. “Anyone who could fog a mirror could get a loan” at an attractive rate. Risky ventures performed well because money was free. In the words of research group Strategas Partners, we might call this era “kindness of strangers.” Following the huge stimulus programs by the government and Fed monetary policy to aid businesses, families, and workers during COVID’s Great Lockdown, the economic and financial market backdrop changed. Huge money supply created inflation; huge inflation spikes were everywhere. Now, the Fed finds itself in a rather odd position where it needs to tighten policy to control inflation and boost money supply to comfort public perspective regarding financial conditions at banks.

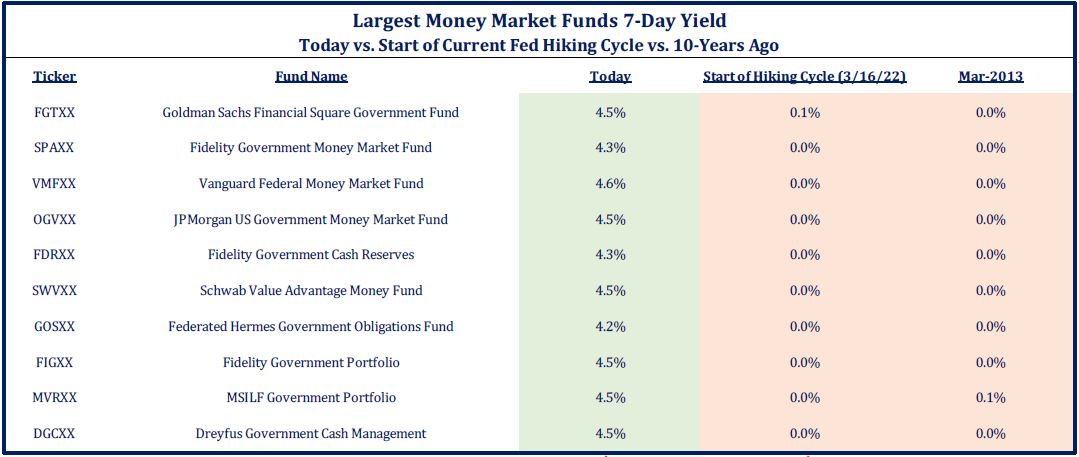

We anticipate interest rates will remain elevated for longer, or stickier than expected. That’s because inflation, while off its peak, will stay elevated and persist for longer. Did kindness shift to investors who now earn higher interest rates on money market savings and bonds? Current interest rates are a massive difference or “sticker shock” for owning MMFs and bonds compared to 0% at the start of the current rate hike process (see chart MMF yields at bottom of this post). Investors worried about the economic outlook now see money market funds (paying 4.5%+) and short-maturity bonds attractive vehicles and provide comfort. They are not however, a long-term investment solution because inflation is their key enemy. Diversifier – yes; inflation fighter – no. [If inflation is 6%, MMF paying 4.5% lose purchasing power by the inflation rate; real after inflation rates are still negative.] In the short-term, they offer attractive current yield and safety while stock market clouds exist.

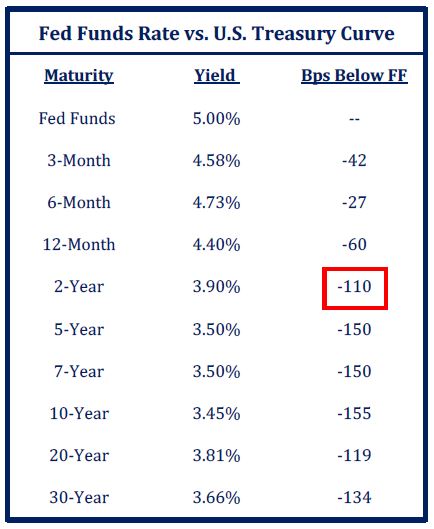

Yield curves and yield spreads are often viewed as a predictive tool about future rates. The current yield curve provides a unique predictive message. Currently, Treasury securities of all maturities (3-month T-Bills, the 2-year Treasury, 5-year, 10-year and all the way to the 30-year Treasury Bonds) offer yields that are lower than the Fed Funds (FF) rate at 4.75% which the Fed started raising in 2022.  The yield curve is inverted (short maturity bond rates are higher than those maturing further in the future; abnormal); a trait existing for the past 11 months. This means a government policy mistake. This is a rare experience. The 2-year calls the shots in bond world, often leading Fed policy on the way up and the way down. The 2-year is currently 110 basis points below FF. History reveals that Fed policy hikes were done when 2-year yields were below FF. Unfortunately, a recession followed. Between 1978-1982, the 2-year was regularly below FF and accompanied a very volatile stock market (sounds like recent experiences). If the 2-year gets its way, the Fed is done raising interest rates; just not sure the Fed is listening yet.

The yield curve is inverted (short maturity bond rates are higher than those maturing further in the future; abnormal); a trait existing for the past 11 months. This means a government policy mistake. This is a rare experience. The 2-year calls the shots in bond world, often leading Fed policy on the way up and the way down. The 2-year is currently 110 basis points below FF. History reveals that Fed policy hikes were done when 2-year yields were below FF. Unfortunately, a recession followed. Between 1978-1982, the 2-year was regularly below FF and accompanied a very volatile stock market (sounds like recent experiences). If the 2-year gets its way, the Fed is done raising interest rates; just not sure the Fed is listening yet.

Further, history shares that recession followed 7 of the last 9 tightening campaigns by the Fed, and today’s inversion is more than any since 1981 when US interest rates peaked. The inversion this cycle started 11 months ago. Since 1978, recessions started 14 months after the first inversion. Recent bank failures are likely to cause savers (consumers) to pull back spending. That can help lower inflation, but also slow the pace of the economy.

This market backdrop warrants investment caution. Caution does not mean stop investing or altering investment objectives (bond/stock mix). Those types of investor actions may provide short-term comfort but will lead to missing the next bull market which no one knows its beginning. Miss the beginning and miss a lot. Charlie Munger (co-key Berkshire partner with Warren Buffett) stated “The world is full of foolish gamblers, and they will not do as well as the patient investor.” Berkshire’s individual stockholders are largely “once-a-saver, always-a-saver” variety. We too encourage clients to find investment amazement through the magic of compound interest in the growth of portfolio values which only occurs by remaining a long-term investor. In other words, timing generates poor experiences.

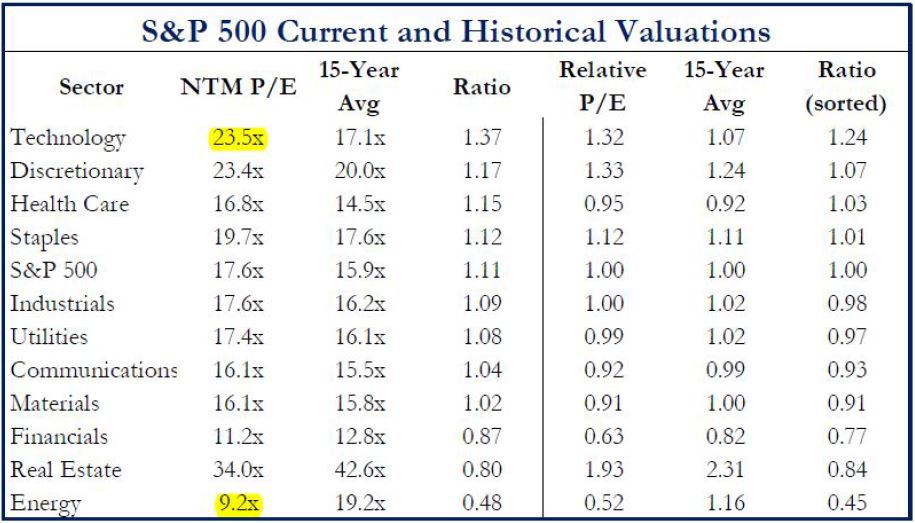

For such a time as this…Expect investing in the near term to be a grind. Stocks and bonds will rally and retreat, rally, and retreat. This is part of the process of wringing out risk which was high when money access was virtually “free” and unlimited. Know too that bear markets ultimately reveal new leaders. That is likely to include dividend paying stocks (short duration) because interest rates stay high, longer; they offer better values. Seek higher quality companies with high return on capital/equity to shareholders.  Technology stocks remain the most overvalued relative the S&P500 index (since October 2007 – chart-tech/energy), while energy and traditional banks are the cheapest sectors… most investors dislike both; that’s contrarian opportunity. And we already discussed the “kindness” of owning short-maturity bonds and MMFs – something we can be comfortable with in the short term, but MMFs are not a long-term investment solution.

Technology stocks remain the most overvalued relative the S&P500 index (since October 2007 – chart-tech/energy), while energy and traditional banks are the cheapest sectors… most investors dislike both; that’s contrarian opportunity. And we already discussed the “kindness” of owning short-maturity bonds and MMFs – something we can be comfortable with in the short term, but MMFs are not a long-term investment solution.

CHARTS OF INTEREST:

Money Market Yields

Many are amazed by the yields currently being paid on money market funds; rates not seen in at least 17 years. While these current yields feel great following an era being at or near 0%, we should recognize that they still trail inflation by roughly the same degree as when inflation was running between 2-3% annually. In other words, while we can take comfort in price stability and yield in the short-term, they still possess no opportunity to outpace inflation over the long-term and as inflation recedes, money market yields should drift lower as well.