M&Ms candy was first introduced to the public in 1941, inspired after Forrest Mars Sr. relocated his Mars candy company to England and encountered British soldiers eating small chocolate beads encased in a hard sugar shell. This shell prevented chocolate melting in the heat of summer (melt in your mouth, not your hand). A couple other interesting facts: M&Ms were sold exclusively to the US military during WWII. Between 1976 and 1987 there were no red colored M&Ms and the color blue was not added until 1995. M&Ms were the first candy to travel into space (1981). Who doesn’t like M&Ms?

Reflecting on investing in 2023, it might be appropriate to label it the year of the M&Ms. That’s because two investing themes dominated investor behavior throughout the year: Money Market Funds and the Magnificent 7(1).

Click here for a Printer Friendly PDF which also includes benchmarking and data on investments widely utilized in our current tactical strategies.

- Money market funds received nearly $1.2 trillion of new money flows in 2023, a +24% increase over year-ago levels. By contrast, equity ETFs and fixed income ETFs received just $388 billion and $207

billion, respectively. Such behavior suggests investors were cautious following an emotionally damaging 2022.

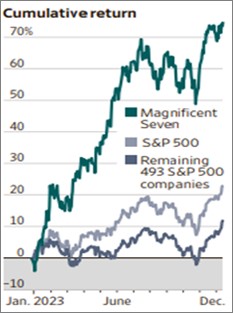

billion, respectively. Such behavior suggests investors were cautious following an emotionally damaging 2022. - In what seems a stark contrast given their already lofty (expensive) valuations entering last year, the “Mag 7” rocketed up more than 70% and provided roughly two-thirds of the S&P500’s return in 2023. Client portfolios own exposure hereto via the position in Schwab Large Cap Growth (SCHG), which logged a +51% return 2023! That’s thrilling! It does however highlight how disconnected the “Mag 7” was from the broader market in 2023.

Neither M&M theme seems characteristic of a robust market environment. Confusion, rather than conviction or confidence, seems to be the most appropriate descriptor for investor sentiment. What did market participants expect for 2023 that either did not materialize or added to confusion (the market does climb a wall of worry, doesn’t it)?

- Entering 2023, nearly every major economist predicted the US economy would experience a recession.

- Market concentration only intensified throughout most of the year despite more attractive valuations in other areas of the market. International failed to lead domestic.

- Interest rates continued to rise, but did not seem to create the financial strain on consumers or businesses that many feared.

- Higher interest rates arguably helped those who refinanced houses, cars, or corporate balance sheets in the last couple years, but hindered others from buying new. Meantime, higher rates hurt Governments such as the US, who needed to refinance maturing debts and continue deficit spending.

- “Green” energy was deeply “red” in 2023; it performed poorly. Perhaps just as surprising: despite ongoing conflict in Russia and a new war in the Middle-East, the price of oil and other notable commodities slipped in 2023.

- China did not enjoy a robust economic recovery following re-open from Covid. In fact, it appears their economy is struggling which may explain weakness for commodity prices.

As we conclude 2023 and are now 14 months since the bear market low (10/12/2022), real encouragement was sparked beginning in late-October as market participation broadened and leadership shifted from the “Mag 7.” Robust advance occurred in smaller-size companies and those with more attractive valuations. This broadening participation by the “average stock” along with bond yields that are more steadied, is desirable as we enter a new year. We are optimistic that inflationary forces can continue to retreat and the market could melt up in 2024; but not naive to expect the experience will be smooth. 2024 will likely offer political noise as well. 2023 was indeed the year of the M&Ms. What should we expect for 2024? Please read on!

(1) Apple, Alphabet (Google), Amazon, Meta, Microsoft, Nvidia, and Tesla comprise the group now widely referred to as the “Magnificent 7”.

Four for ‘24…and Dirty Laundry

There’s a saying that hopes and dreams are not a viable investment strategy. Following the hot, cold, hot market experiences in the months since Covid, it would be great to hope for a more “normal” investing experience in 2024. Unfortunately, the year ahead will endure several national elections, including the US presidential election. Around the globe, elections will span more than 40% of the world’s population and 80% of its total stock market capitalization. That probably means there’s a good bit of “Dirty Laundry” to be observed in the year ahead. [Bill uses these ‘messy’ Presidential election years as his cue to schedule his home’s quadrennial septic system service!] Geopolitical conflict also persists around the world, lending to the idea that we should anticipate twists and turns. Yet as we consider tactical construction of client portfolios with awareness to what we see coming in the year ahead, we find ourselves cautiously hopeful. Why? Four themes for ‘24:

- Fed rate cuts are likely later in 2024, and may help the yield curve un-invert. We are skeptical that there will be as many cuts as the market anticipates, and believe longer-maturity yields are likely to remain sticky or even experience a touch of upward pressure. Fixed income (bonds) will provide a less volatile and more normal performance experience than over the last two years.

- Unemployment will continue to drift upward, but not to a degree that significantly damages consumer confidence and spending (and consumer spending represents more than 70% of US economic activity). Commodity prices should stabilize in 2024. While inflation eased significantly around the world in 2023, and further softening is anticipated in 2024; history shows another smaller wave may return (up/down/up/down cycle). Inflation may not decline as quickly as over the last 18 months; we wrote in December the “last mile is often the longest”. We anticipate the Fed will orchestrate a “softish” landing and avoid a deep, or possibly any, recession in ‘24.

- With the cost of money remaining higher than prior to 2022, companies that generate free cash flow and pay dividends should be attractive to investors. Smaller-sized companies and those trading at more

attractive valuations also seem poised to outperform after lagging behind the “Mag 7” for most of 2023.

attractive valuations also seem poised to outperform after lagging behind the “Mag 7” for most of 2023.- Politicians vying for re-election will pull every lever in their power to keep things positive and avoid a recession. It’s worth noting the S&P500 increased in every presidential re-election year since 1944.

Politics are sure to be an area of focus for individuals and perhaps even provoke some to consider moving to the sidelines to avoid feeling vulnerable to the “dirty laundry” that lies ahead. Yet history supports the idea that we must not allow politics to take us off course from pursuing our long-term asset mix objectives. The economy and markets find ways to adjust to ever changing policies. The burden of proof is on the bears following such a strong finish to the year and improving participation under the surface. If nothing else, the last 12 months are just the latest example of how the market often climbs a wall of worry; or that the biggest thing we should fear when investing is fear itself. We are thankful for improving trends and broader participation that developed to conclude 2023. But we anticipate a more average full year return experience, and no shortage of nervous moments with elevated volatility.

We encourage clients to look through the “Dirty Laundry” related to politics, and stick-fast to the asset mix determined appropriate for your portfolio’s time horizon and purpose. Our long-term process is data driven in the pursuit of keeping emotion out of the investment mix; this leads to long-term success. Oh… and while scratch-off lotto tickets are not part of our recommended investment strategy, we won’t judge if they’re a small part of yours!

Steve Henderly, CFA | Nvest Wealth Strategies®

THE PITFALL OF FINANCIAL SPRAWL

Happy New Year from your team at Nvest! As you turn the page to 2024, is this a good time to reflect on your financial big picture? Is it appealing to make financial life simple?

Many clients in the Columbus area, as well as other urban areas, are well aware of urban sprawl. It’s seems to be a growing concern and frustration. Developing and sticking to a “grand plan” can be challenging for local politicians. Despite good intentions, communities often deviate from the grand plan as differing views and priorities are brought forward. These quickly distract from the big picture.

Many clients in the Columbus area, as well as other urban areas, are well aware of urban sprawl. It’s seems to be a growing concern and frustration. Developing and sticking to a “grand plan” can be challenging for local politicians. Despite good intentions, communities often deviate from the grand plan as differing views and priorities are brought forward. These quickly distract from the big picture.

Sprawl can occur for individuals as well. For example, it is easy to get pulled in more directions than time permits. It’s also easy to create “financial sprawl” over many years. If not intentional, one can find themselves with multiple savings & checking accounts, old retirement accounts inappropriately invested, a stock or two once considered a “slam dunk opportunity”, insurance and/or annuities misaligned relative to current goals, and perhaps various credit cards. Sound familiar? When and how is it appropriate to simplify or correct personal “financial sprawl”?

One of our core financial philosophies at Nvest is to keep financial life simple. Keep your finances organized, efficient, and manageable. Follow Benjamin Franklin’s advice – ”A place for everything, everything in its place”. A few more Nvest core principles: No investment or product should ever control you; Avoid insurance products which claim to offer investment like returns (ie. whole life, annuities, etc.); and be wary of products that promote outsized returns but sacrifice liquidity (REITS, alternative investments, private equity). There are no “free lunches” with financial products.

its place”. A few more Nvest core principles: No investment or product should ever control you; Avoid insurance products which claim to offer investment like returns (ie. whole life, annuities, etc.); and be wary of products that promote outsized returns but sacrifice liquidity (REITS, alternative investments, private equity). There are no “free lunches” with financial products.

Retirement accounts with pre-tax contributions (401k’s, 403b’s, other IRA’s) can be consolidated into one IRA and invested appropriately for the time horizon and purpose of the account. Investment performance becomes cloudy and difficult to manage as the number of accounts increase; RMD calculations can become complex and cumbersome. Requesting distributions from multiple accounts can be time consuming and frustrating. Some custodians even require notarized paperwork (!).

Utilizing multiple banks, each with savings and checking accounts, creates challenges for understanding cash needs and expenses; financial life can feel overwhelming. The same is true for holding or using multiple credit cards. Are each of these accounts truly necessary and appropriate, or just adding complexity?

Regarding insurance, we encourage clients to regularly monitor and adjust. Consolidate products via a 1035 exchange (avoids taxable income). Is the product or policy still appropriate? Perhaps you no longer require life insurance, in which case closing the policy and receiving the cash value might be appropriate.

As your financial life is streamlined, it becomes easier to maintain an intentional asset mix and big-picture investment strategy. Developing a clear withdrawal strategy to support living expenses can help avoid “lumpy” withdrawals, which thereby assists to minimize tax liabilities. Importantly, avoiding “financial sprawl” helps a spouse or loved one understand and administer your financial affairs (goals) if/when you someday require assistance; estate planning can be simplified too.

If you feel you might be living with “financial sprawl”, we are happy to help. We regularly help clients simplify their financial life and thereby maximize its potential. Knowing one’s finances are simple and organized is a big step toward “financial peace of mind.” That’s our ultimate goal. Please reach out if we can assist!

Jordan Ranly | Nvest Wealth Strategies®

Zooming In on the “Mag 7”

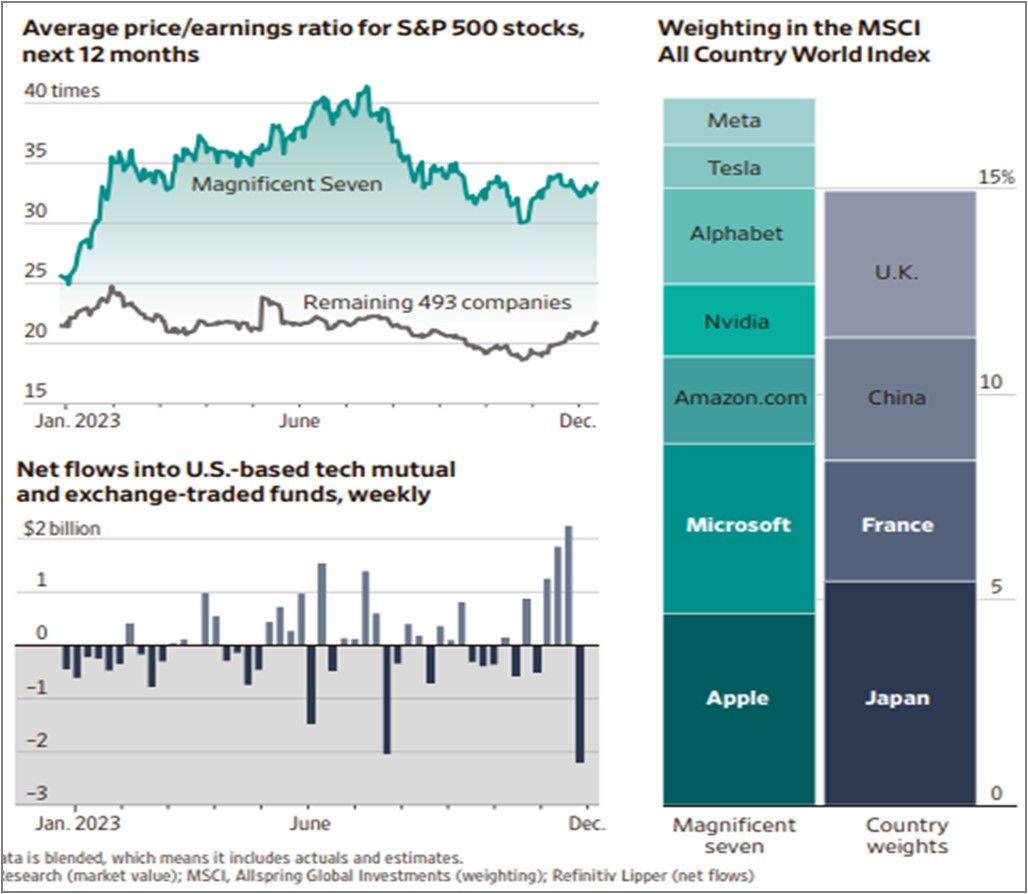

We highlighted the incredible performance of the “Magnificent 7” group of stocks often throughout 2023. The WSJ published the charts to the right in late December, as well as the one appearing on page 1 of this newsletter.

There are so many talking points relating to this Mag 7 theme. For example, these seven companies comprise a bigger weight in the MSCI World Index (also cap-weighted like the S&P500) than all companies in Japan, France, China, and the UK combined! Their average P/E began the year at roughly 25.5x, but surged to as high as 40x by mid-year, while the remaining 493 companies in the S&P500 sport a P/E multiple of around 20x. Time will tell, but with these 7 receiving so much attention for their dramatic divergences (performance, valuation, size, etc) from the rest of the market, it seems probable that analysts and investors might begin to look to other areas of the investment landscape for leadership in 2024 and beyond.