Getting ketchup from its bottle is often messy. It never wants to flow easily. The container must be shaken vigorously, or squeezed a lot to find that it still does not come out. Eventually after enough frustration and squeezing, ketchup will flow – often after it explodes with too much red sauce going everywhere. This month, title alternatives were “Ate Way Too Much” (at Thanksgiving), or “Monster Snow Storm” is brewing. Both of these ideas relate to news/media sensationalizing new worries which then affect the financial markets. Following 20 months of market advance with only minor pullbacks, most any new “worry” can cause the market to feel “bloated”.

Ketchup Bottle it is. The Financial Times (periodical 5/23/2021) recently used this title to key on 4 main bottlenecks affecting the US and global economy and thereby causing inflation. Don’t forget there was huge government financial stimulus that encouraged consumer spending (demand) way above available product supply. The COVID Great Lockdown and financial stimulus created big bottlenecks in the supply chain. There is evidence beginning to appear that 3 of the 4 bottlenecks may be peaking. Unfortunately, until these clear, inflation will likely run high. It’s possible that when the bottleneck ends, where unclogging supply chains actually occurs, there will be a rush of products and supplies to the market place. It’s like what happens after you shake or pound on a ketchup bottle with no result, until it finally “explodes” or releases and it all comes flooding out. Until “peak bottleneck” occurs, there will not be “peak inflation.” We are not there yet; and new COVID variants create the “monster snow storm” hype. Beware – the ketchup bottle economy. [By chance you are wondering what are the 4 bottlenecks: Product – semiconductors, auto, China exports => close to peak concern; Transport – ports, international travel => close to peak concern; Labor – significant retirements, wages rising, government support => close to peak concern; and Energy – green focus without transition process => wild card issue.]

Inflation is the top issue right now. Surveys indicate that the general public is more concerned about inflation than unemployment. Probably because inflation numbers are “out-of-bounds” with recent experience. The bottleneck components are complex and overlapping; they are everywhere, including the US and global economies. Consumer staples costs are up +13.3% (second highest reading back to 2008), and often pass quickly in prices to the end product that consumers buy. The jump in oil prices this year are like a tax that hits hard. Inflation numbers are getting worse, and likely to be experienced in all our checkbooks before getting better. The Fed and other global monetary authorities are beginning to take action to address current high inflation – hoping to arrest it before it becomes too sticky. There is still a belief (hope) that it will be transitory or temporary. But, the longer it lasts the harder it will be to “shake it loose”. Maybe the ketchup bottle “explosion” will deliver excess products/goods to what consumer demand will require. That will cause prices, in some areas, to decline. Others prices will likely remain sticky.

During November, the stock market established 8 new closing highs; the 67th of the year occurred on November 18th. While that sounds exciting, market action under the surface was fitful. The S&P500 ended the month with a slight -0.7% loss, and remains in strong performance territory for the YTD; returns remain spectacular since the new bull market began 20 months ago (March 23, 2020). On Black Friday (the bargain priced retail day following Thanksgiving) a new COVID variant was discovered in South Africa. Following the long weekend, Fed Chairman Powell indicated greater concern for inflation and floated thoughts to accelerate the pace of winding down of bond purchases (used with low interest rates) to boost economic growth. He even hinted about considering to begin raising interest rates in early 2022. Together, these two unexpected items created new worry, and the news is running with it. It’s similar to the “monster snow storm” expected to arrive, or I’m uncomfortable after eating too much turkey dinner; they are quick, unexpected stories that create immediate uncertainty.

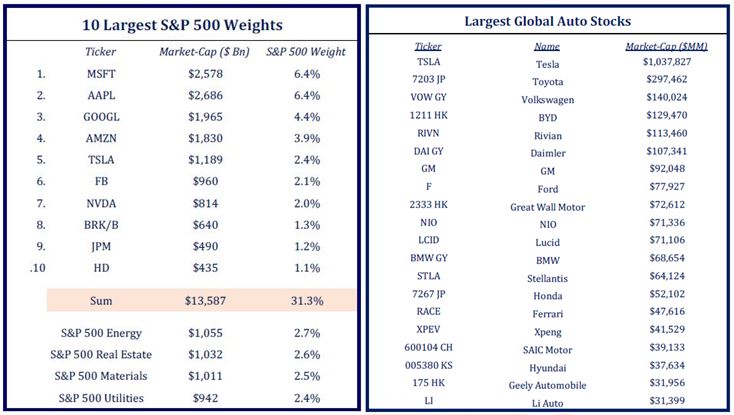

As shared above, market action under the surface was fitful in November. In fact, since May the average stock and smaller company stocks in particular, are traveling a sideways path; not making much progress. New market highs posted by the index are fully the result of outsized performance by just a few company names. The S&P500 is off -2.9% from its last high on 11/18, but the average S&P500 stock is down -14.3% from its 52-week high; correcting while the Index is reporting good numbers. That disconnect is because the top 5 largest companies in the S&P500 (Microsoft, Apple, Google, Amazon, and Tesla) combine for 23.7% of the index weight; the top 10 names account for over 31% of the index. They can easily mask what is the overall market’s behavior. Similarly, client portfolios are lagging the S&P500 in recent months. We remain tactically positioned for cyclical recovery and expectation that the interest rates will gradually rise (two factors that tend to benefit smaller-size companies and areas like financials, industrials, materials, etc.). Understanding this further, energy represents only 2.7% of the S&P500 Index; real estate is 2.6%; materials comprise 2.5%; and utilities just 2.4%. In a not different way, looking at the largest global auto stocks – Tesla is valued at $1.04 trillion market cap, while the next largest is Toyota at $297.4 billion; Volkswagen is 3rd at $140 billion; with 7th being GM at $92 billion and #8 Ford market cap of $77.9 billion; does that say something about valuation, or over-valuation of Tesla and the largest 5 S&P500 companies?

Inflation, taxes, and labor are the most important current problems for businesses; inflation and taxes are a concern for most individuals as well. Interestingly, small company stocks are the only asset class to outpace inflation in every decade since the 1930s. Large company stocks do well dealing with inflation, but did lag behind inflation in the 1930s, 1970s, and 2000s. Stocks provide inflation protection, or hedge, because they can raise prices on products/services as costs rise. Bonds are not good at combating the effects of inflation since their coupon/interest rates are fixed and cannot be repriced. Client portfolios own stocks and bonds (good diversifier to stocks and provide liquidity when “rainy” days occur that drawdown values), which together historically provide a good offense in fighting our investment enemy of inflation (and taxes).

How about thoughts on the outlook? Winter is near at hand, like Christmas and Santa Claus. We will experience some snow, and maybe eat a few too many Christmas cookies. From an economic perspective, the 4Q is continuing to be strong, showing considerable momentum in the US. There are new near term risks if health restrictions disrupt supply chains again/further. Another relates to when and how fast the Fed changes its current monetary policies – accelerating the pace of ending its bond buying plans to position for interest rate increases in 2022 to address inflation concerns. Continued economic growth in coming months (time) will allow for “peak bottlenecks” that lead to “peak inflation” in 2022. Hopefully, the Fed and other central bankers will not need to be too aggressive (too fast or too much) raising interest rates that would hurt economic recovery/growth.

Historical experience shows December as one of the strongest months of the year; it should provide reprieve from market experience in November, albeit how the government deals with the Federal debt ceiling (kicked the proverbial can down the road from October) and communication from the Fed on adjusting current easy monetary policies. Since 1950, there are 23 examples of a negative November performance for the S&P500, including November 2021. Surprisingly, the historical stats show December returns higher (+2.7%) than average (+1.5%) following all but 3 of those negative Novembers. Those negative observations were 1969, 1974, and 2007 during market environments that were already in down trends or bear markets; which is not the case today.

Turning the calendar to 2022, aside from watching the Fed and looking for “peak bottlenecks” which could slow US and global economic growth, the US stock market will monitor political winds relating to Congress’ midterm elections. The markets could exhibit increased volatility relating to uncertainty. Since 1950, the average midterm election year included a drawdown for the S&P500 of -17% in its course. Don’t fret; this is not a “lump of coal” in your Christmas stocking! It’s important to know that the ensuing twelve months from the midterm drawdown is often a positive advance experience, often rising between 20 to 30 percent. We should always remember that long term investors look past short term worries. They know that compounding returns over time become attractive to those who continue to invest through uncertainty. They understand that attempting to time the market creates a poor and frustrating experience.

Enjoy a Merry Christmas and Happy New Year holidays with family and friends. Be careful monitoring too much “bad news”, eating too many cookies (leave them for Santa), or shaking the ketchup bottle too vigorously.