As we move into the 2nd half of 2020, we are struck by how much is changed from just 6 months ago. A global health crisis/pandemic thrust the world into what is arguably the deepest and sharpest economic recession in a generation’s memory. If that were not enough, the backdrop of acute economic pain combined with several most unfortunate societal tragedies to create a degree of social unrest not felt so acutely in many years.

Despite these dynamics, the 2nd quarter provided strong recovery for global financial markets. Most attribute this almost unbelievable market rebound to a forceful fiscal and economic policy response by governments globally. In this quarter’s newsletter (below), you’ll find 3 brief articles. The first, entitled “65 Days… Now What?”, places the strength of the stock market since the March 23 low in historical context and reviews the actions we pursued early in the 2Q to position portfolios for economic recovery; “Offense Still on the Field” explains how the process of reopening the economy will remain complex amid lingering fallout from the reality of covid-19. Lastly, “True vs. True? And Truth!” examines the Great Depression era (1930’s) and the series of what are now considered consecutive policy mistakes that likely kept both the economy and financial markets impaired longer than if different actions were pursued. Studying these is relevant to the path forward.

A printer-friendly version of our quarterly newsletter can be obtained here: Q2 Nvest Nsights

65 DAYS… NOW WHAT?

June 23 marked 65 trading days (3 calendar months) off the March 23 low. The S&P500 gained +36.3% over that stretch; a recovery that in itself suggests the bear market is over. Yet, it is challenging to find any bear market associated with a recession that lasted only four weeks. [From the low on March 23 thru June 30, the S&P logged an advance of +39.3%.] That gain ranks third best in history, only barely trailing the initial surge off the 2009 financial crisis lows (+38.8%; the start of the now deceased nearly 11-year Bull market), and the 1982 low (+38.7%). That’s good company. More important is the encouragement it should provide to investors who maintained discipline to avoid powerful emotions of worry and remain invested. The S&P500 jumped +20.5% during the 2Q (best in 20 years). Many market players now expect a pause in the near term – particularly due to usual sideways summer seasonality and also the uncertainties of the upcoming November Presidential election. History shows weak forward returns are likely in the short-run; but strongly supportive of very attractive forward returns over the next +6 and +12 month intervals. [Please see “Offense Still on the Field.”]

Following what is arguably the fastest and steepest decline into technical recession ever, we took action to reposition client portfolios early in 2Q for expectations of economic recovery. Tactical adjustments within stock allocations included boosting exposure to funds concentrating on small- and mid-size companies that emphasize quality financial-managed businesses (Active fund/portfolio management). This is because smaller- and mid-size companies usually perform faster, rise more than large company stocks in the early innings of economic recovery. Also, foreign stocks are generally rebounding faster than domestic; likely attributable to their cheaper valuations and earlier “walk-back” strategies from COVID-19. Additionally, tactical adjustments within bond allocations included use of well-defined bond strategies with emphasis on higher quality balance-sheet businesses. These tactical adjustments show early strong performance in client portfolios. We anticipate they will continue to accrue attractive portfolio benefits.

It is critical to maintain a long term investment focus. It is amazing looking back, that the market always climbs a wall of worry; there are always market risks on the horizon. Yet history reveals that the market rises longer and more than it falls. Inevitably, those who too closely watch/listen to the “bad news bears” succumb to wrong investment action and/or disconnect from their time horizon. Often, such emotion reactions destroy investment capital and slow a portfolio’s ability to recover. It is critical to pursue an investment process that is disciplined, proven, and repeatable. In managing client portfolios, we continually pursue these portfolio management traits, and also find them in successful no-load mutual funds and ETF we utilize. History proves staying invested works well.

OFFENSE STILL ON THE FIELD

It seems like an eternity ago when life seemed normal. Unexpected levels of uncertainty were our collective experiences during the 1st half of 2020. The coronavirus wrecking ball was terrible, leaving heartbreak, economic ruin and social disruption in its wake on a scale not recently experienced. The government-mandated economic lock-downs, to a near-subsistence crawl, created chaotic volatility in the capital markets. When you add the “merchants of bad” – journalists, politicians, and self-appointed experts – to set the narrative, it’s easy to create and flame outsized risk of fear. Unfortunately, “bad” news carries more power to influence our attitudes than “good.”

Catch your breath. It is probably safe to say that the US recession of 2Q is over. If so, it is also likely the shortest deep recession in history. The initial trajectory for economic stats should now remain upward from very low, depressed levels. Recovery is underway; appearing as a “V” at first, yet it is now likely entering a slower phase. It is reasonable to expect recovery to get fully back to 2019 economic and employment levels in a socially-distanced world will be difficult. Severe damage to employment will take time to fix; and its lingering effect is unstable economically and politically. Lockdown is somewhat easy. But reopen does not mean an easy return to normal. There will continue to be a “push and pull” between reopen and virus cases. Until schools are able to reopen (not in part or staggered schedules), economic/employment recovery will be limited. Unfortunately, a rise in new COVID-19 cases will also slow re-opening plans and the near-term pace of economic recovery. At some near future point, both medical (treatment and vaccine) along with the math of COVID (when more than half of the population is exposed) will reflect a slowing trend of exposures. Then, full re-open should be achievable and economic/employment growth will become more stable.

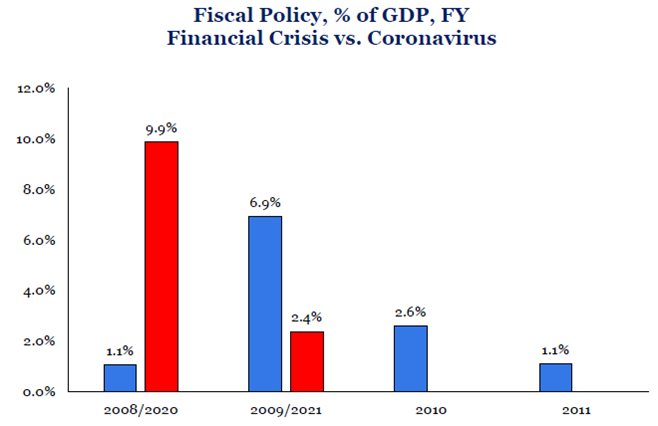

The US and other global governments took extraordinary “shock and awe” action (fiscal and monetary) to calm and stabilize turbulent times. At present, the “offense” (Fed and global monetary & fiscal policy stimulus) is still on the field. It is reasonable to expect some continued monetary and fiscal stimulus will be utilized to boost economic and employment recovery; fiscal policy (social programs) are more effective than monetary (low interest rates) in providing near-term cushion.

The US and other global governments took extraordinary “shock and awe” action (fiscal and monetary) to calm and stabilize turbulent times. At present, the “offense” (Fed and global monetary & fiscal policy stimulus) is still on the field. It is reasonable to expect some continued monetary and fiscal stimulus will be utilized to boost economic and employment recovery; fiscal policy (social programs) are more effective than monetary (low interest rates) in providing near-term cushion.

One significant challenge from the Great Lockdown is fallout – supply chains were damaged or altered with some production returning to the USA; unemployment will lag the economy; China/US relations and trade are percolating again; China/Hong Kong tensions are high; and then there is the noise of November elections. There still remains the unknown of when and how government stimulus will be phased out? The Great Lockdown is over, but the fallout is likely complex and possibly long-lasting.

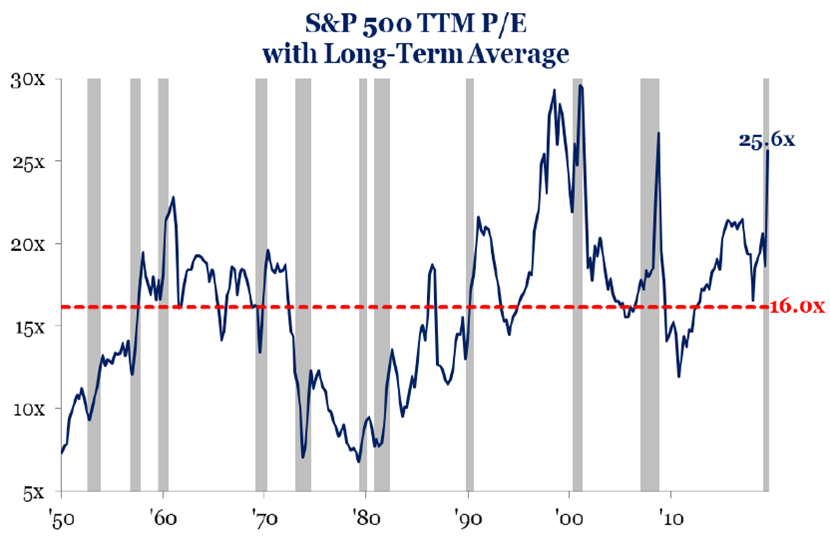

Presently, the economy and financial markets appear to be diverging. There are stark differences between economic GDP and the S&P500. Economic recovery lags the stock market. Or said differently, the stock market leads the economy with a forward view. For this reason, it is normal for multiples (valuation) on stocks to surge near lows in economic growth causing them to look wildly expensive (see chart below). The result is valuations become somewhat meaningless in the early stages of recovery. Yet, valuation differences between asset types or styles reveal areas with better (cheaper) prices. Given the amount of Fed monetary support/stimulus, the only rule appears to be that there are no rules at the moment [other than perhaps the phrase “don’t fight the Fed”]. Still, “caveat emptor” – let the buyer beware – remains an important principle for investors too. Be careful; do your homework; understand high-leverage, high debt investments. This market environment, including the approaching November elections, present an inflection point for Active investment management (not passive, own it all). Quality and marketability are always important components for successful long-term investment success.

TRUE VS. TRUE? AND TRUTH!

If a blue light is shown at one end of a solid cylinder, a blue circle (with a dark center) is displayed on the surface beyond it. The observer understands the blue circle is a “true” representation. At the same time, if a yellow light is projected on the side of the same solid cylinder whose length is equal to its diameter, a yellow square box appears on the surface beyond it; an observer would claim the yellow square box is a “true” representation. Which perspective is “true”; or is one perspective more “true” than the other? How something appears is a matter of perspective. Often, both perspectives are equally “true” depending on the viewing angle. The real “truth” centers with the character of the solid cylinder – it creates the shadow images when light is shown upon it from one angle or another.

If a blue light is shown at one end of a solid cylinder, a blue circle (with a dark center) is displayed on the surface beyond it. The observer understands the blue circle is a “true” representation. At the same time, if a yellow light is projected on the side of the same solid cylinder whose length is equal to its diameter, a yellow square box appears on the surface beyond it; an observer would claim the yellow square box is a “true” representation. Which perspective is “true”; or is one perspective more “true” than the other? How something appears is a matter of perspective. Often, both perspectives are equally “true” depending on the viewing angle. The real “truth” centers with the character of the solid cylinder – it creates the shadow images when light is shown upon it from one angle or another.

Let’s shift to look at the world of economics, financial markets, and political responses: what historical perspective can be gained from the Great Depression and recent government policy responses relative to COVID-19? How do they influence current/future market and economic events? Where to from here?

The Great Lockdown is much different than the Great Depression. With hindsight, the recession that started in 1929 was marked by incorrect hyperactivity by government. At various times during the Great Depression, the US made grave policy mistakes – it raised tariffs through the passage of Smoot-Hawley (1930); tightened monetary policy dramatically (1931); instituted price controls (1934); raised marginal income tax rates and introduced a tax on undistributed corporate profits (1935); increased reserve requirements on banks (1936); and introduced a huge array of regulations on businesses. And while the New Deal introduced protections for labor and oversight of financial markets, and was accompanied by impressive public works initiatives. Author and columnist Amity Shlaes argues in her “The Forgotten Man” that government policies did more to lengthen economic misery than to relieve it. All these actions were well-intentioned attempts to help those who were suffering. Interesting, with hindsight being a perfect 20/20, capital (money) “went on strike” due to not knowing how and/or when the rules on it might change.

After falling 90% from 1929 to 1932, the market rallied 372% from 1933 to 1936. But the tax increases knocked the market down again in 1937-38 with a fresh -50% decline. In the end, the Dow Jones index did not surpass its 1929 high until 1954. Wow; that’s a real travesty for savers! Government policy actions influenced “life” for years.

Fast-forward to the Great Lockdown of 2020. Many government policy actions were taken from the 2008 “financial market bubble” playbook to provide aid during this health crisis – revert to zero/no interest rate easy money policy and massive securities purchases to stabilize (backstop) financial markets; and provide huge fiscal policy spending for social program support. Like it or not, given the ballooning deficits (Federal and state), higher future taxes may be considered to make any recovery in the economy “fair” via social engineering. In addition, government involvement in personal and corporate lives (because economic/financial support was huge during the virus) is very likely, and could pose a dangerous future mix for savers/investors of any size. Did we learn from the 1920s? “Experience is simply the name we give our mistakes” – Oscar Wilde.

Did you know? Data since 1928 shows the incumbent party winning the Presidential election 87% of the time IF the S&P500 is positive over the 3 months leading up to the election; conversely that party loses when returns are negative. Another data study indicates that usually an incumbent President does not win re-election when a recession occurs within two years before election (Calvin Coolidge was the exception). Both of these opposing factoids are presently “true” experiences. What will be the “truth” in 2020? Government policy actions (current and future in particular) dealing with COVID-19 and the Great Lockdown could create long-term influence/effects on many aspects of life in America.

Stay alert, but stay invested. Investing a portfolio for “tomorrow” should involve adapting and evolving with government policies – meaning, some investments will take favor over others.