After a nice start to 2023, the market soured in the 3Q. Both stocks and bonds struggled against a backdrop of too many conflicting signals. Some data such as resilient employment and consumer spending suggests inflation is easing and economic recession may be avoided; but a contracting money supply, abruptly rising interest rates and energy prices, and uncertain government spending suggest economic pressure is building and is causing stock prices to contract.

Hamas’ attack on Israel over the weekend (on top of ongoing situation between Russia/Ukraine) seems to create additional fog in the short-run. We’ll continue to monitor what these developments may mean for the market. In the meantime, this quarter’s newsletter reviews:

- “Too Many Moving Parts” – we explain how many different moving parts not functioning together, can create a frustrating market environment with elevated volatility but no apparent trend.

- “New Reality” – Interest rates are now at their highest level in 16 years. While it feels unfamiliar, history would suggest rates at this level are not a bad omen for the future, but they do not make economic conditions easy either. How long might rates stay high if inflation is improving and what does it suggest for financial assets?

- “Flying Blind – Ecstatic Appreciation” – Bill offers quick reflection and appreciation for the opportunity to work with so many wonderful clients over his 45 year career. As throughout life, “Flying Blind” also offers relevant parallel as investors often feel foggy about the future.

- “The Wealth Feedback Loop” – the wealth effect can cause individuals to alter their consumption behavior, and we discuss why it is important to balance significant financial decisions with actual income rather than fluctuations in net worth due to market variables.

Click here for a Printer Friendly PDF which also includes benchmarking and data on investments widely utilized in our current tactical strategies.

TOO MANY MOVING PARTS

September was a tough month for investment as both bonds and stocks struggled. Even consultants shared it was the worst month for a “60/40” portfolio in 12 months. And, when the S&P500 records its worst performance month (worse than February), investors get bewildered. September is historically a softer performance month in the calendar, with October grabbing some headlines due to several confidence-breaking corrections during the past 100 years. When adding August negative performance with September, the 3Q23 reduced YTD returns and portfolio values. No asset class – from emerging markets, bonds, or low volatility were positive. There were outsized losses in high beta technology names and long maturity bonds.

The current market and macro environment is characterized by too many moving parts that are not functioning together. When this happens, it results in wounded trends, or a market without leadership; sentiment being fragile, but not panicked; and very frustrating market conditions. At the core are government policies that are shifting away from stimulating the consumer/public and moving toward subsidizing public investment. Let’s explain. COVID-related subsidies are ending: student loan deferrals, small business tax refunds, and child care spending. It results in lower transfer payments (income) which softens consumer spending. Ramping up is new investment in infrastructure, clean energy, and semiconductor chips. These subsidizes impact the economy with a long lag. In effect, this policy approach picks winners (and losers). Troubling is the doubling of US budget deficit from $1 Trillion to $2 Trillion during the past 12 months, despite full employment. And interest expense on the federal debt is now consuming roughly 14% of annual tax receipts. Markets, rather than the Fed, set rates in the final leg of the tightening process that started 18 months ago with the first rate hike. Historically, when interest expense reaches 14% of tax receipts, markets – via “bond vigilantes” – pressure government officials to address/curtail spending and/or incur new taxes. Their action is now visible via the fast-rising yield on 10-year Treasury Bonds. Anticipate that the word “Austerity” will return to the financial media and politician’s vocabulary. With this tension about the increase in government spending, the investment backdrop becomes uncertain and confused.

NEW REALITY

“Welcome to your new reality. Is it everything that you thought it would be?” That’s the start of the chorus of a song by The Word Alive. Listening briefly to the lyrics, it’s easy to state this is not a song or music group that inspires me. This article title was chosen and then the chorus was discovered; it offers a good intro. Seems we are continually entering a new reality for life – leaving home to attend college or getting married; kids and activities juggled with work; then empty nesting and retirement. [For me, retirement starts November 1st]. What’s our new reality? It’s part of our changing stages of life. How do we navigate new realities as each can create different stress? Let’s consider a major life area of economics and investing – it’s our New Reality.

Until the interest rate direction changes, the trend of higher yields remains. The Federal Reserve is on record stating they will maintain interest rates higher for longer. Higher interest rates can intimidate everyone and everything. Stocks struggled in September; bond yields rose (prices fell as they move in the opposite direction); and the US dollar strengthened creating challenge for US business when selling products overseas. Inflation is abating (down from 9%+ in July 2022 to 3%+ now), but high rates remain a cruel “tax” – straining businesses and consumers who borrow and government finances. High(er) interest rates for longer create our new reality.

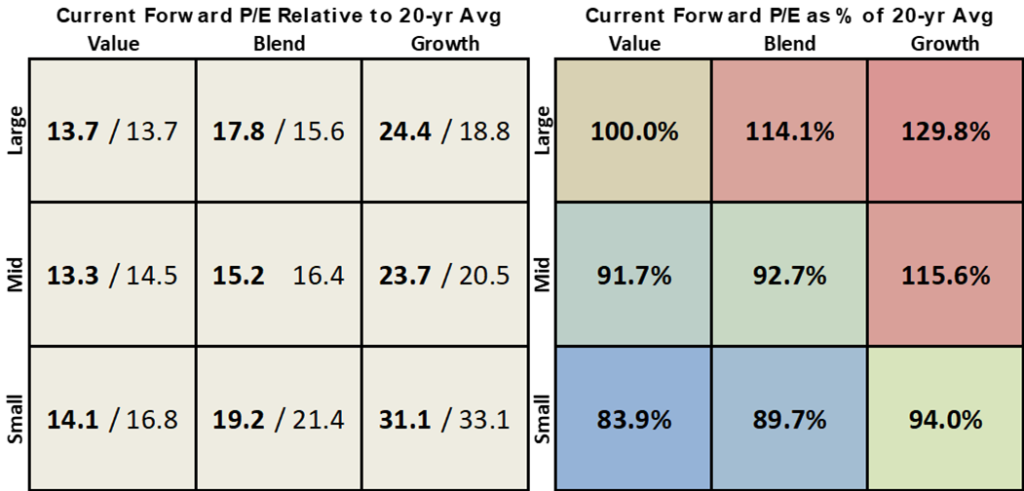

At 3Q-end, interest rates are the highest in 16 years. They are higher today than when the stock market bottomed on October 12, 2022. History would share that rates at this level are not a bad omen for the future, but do not make economic conditions easy. They constrain economic growth and thereby market upside opportunity. High rates for longer are likely to mute market advances and returns because high rates change the valuation criteria on all investments. In general, stocks become “uncomfortable” with yields moving higher.

Why is it possible that rates remain higher for longer, particularly if the economy is softer? Current labor participation is high; unemployment is low as employers retain workers that are in short supply. That keeps wage pressures stubbornly elevated, impacting pricing of products and services; this ultimately impacts profitability. To constrain wage-price inflation challenges, the Fed will keep interest rates higher for longer. It’s also important to understand interest rates relative to inflation. Historically, 10-year yields were about 2% higher than headline inflation (CPI). That was not the experience over the past 20 years. With the 10-year Treasury yield now at 4.75% and inflation at +3%, market rates are close to historical norms of 5%. If inflation does not recede much from here, why should rates ease?

These higher rates are trickling down to consumers; home mortgage rates are approaching 8%; auto, credit cards and other loan rates are higher. Add the resumption of monthly payments on suspended student loans while other costs (gasoline and food) remain high, the current economic backdrop could be sluggish and softer. And that means investment assets undergo ne w valuation metrics. Rich or expensively valued stocks could be vulnerable to re-valuation and/or slower softer returns. If one can earn 5% on money market funds, other investments that produce immediate cash returns to investors are attractive relative to price-appreciation-only growth names. Valuation is always a key discipline when considering investing in any asset – bonds, stocks, real estate; even venture capital. Interest rates influence valuation.

w valuation metrics. Rich or expensively valued stocks could be vulnerable to re-valuation and/or slower softer returns. If one can earn 5% on money market funds, other investments that produce immediate cash returns to investors are attractive relative to price-appreciation-only growth names. Valuation is always a key discipline when considering investing in any asset – bonds, stocks, real estate; even venture capital. Interest rates influence valuation.

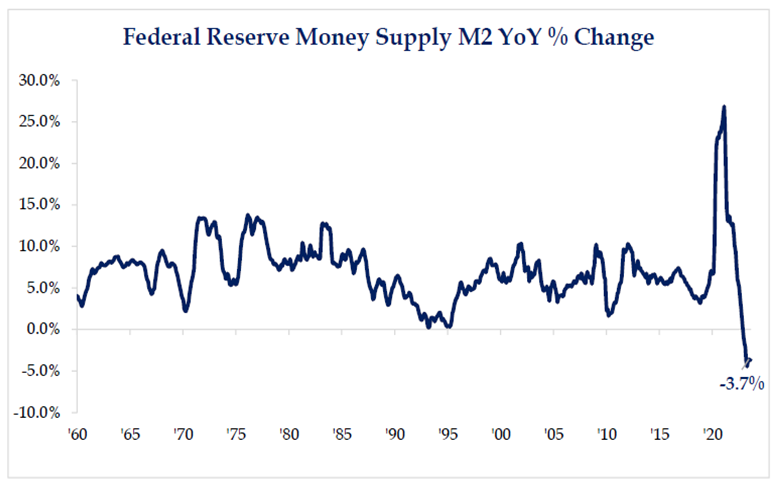

We often talk about money supply (M2) and/or money growth because it influences financial market action. Monetary conditions moved beyond the neutral level (following the many Fed rate increases over the past year). That means liquidity is tighter and more “scarce”. The higher cost of money makes it more challenging to borrow and cover interest expense when the economy is soft. Growth and earnings expectations are not keeping pace with the growing costs of liquidity. It may take another 12 months for a more solid growth backdrop to re-emerge.

What should investors do? Pat Riley’s quote, “keep the main thing, the main thing” is timely and appropriate. Until the market changes its perspective, the trend in yields remains higher, and likely for longer. Don’t take these comments to arrive at the perspective it’s a wrong time to invest. Given every investor’s time horizon, correct asset allocation (objectives) is key to beating your two enemies – inflation and taxes. Tricky investment environments require pursing a tactical mix that can navigate the times. That mix involves shorter duration assets: short and intermediate bonds, and shorter-duration stocks (paying dividends to shareholders). Caution should be utilized when owning long duration assets: long maturity bonds and high-priced growth stocks (with low/no dividends). Saying it again, until the market changes its perspective (because of current government fiscal policies in particular), the trend in yields remains higher for longer. We are keeping the new reality in mind as we tactically invest portfolios.

FLYING BLIND – ECSTATIC APPRECIATION

“More to Your Story” by Max Lucado is a wonderful, fun read. A true story is shared that relates with many walks in life, including ongoing investor feelings of the past and even today.

“You think it’s hard to walk in the dark? Find it difficult to navigate a room with the lights off or your eyes closed? Try flying a plane at fifteen thousand feet. Blind. Jim O’Neill did. Not that he intended to do so. The 65-year-old pilot was forty minutes into a 4-hour solo flight from Glasgow, Scotland to Colchester, England when his vision failed. He initially thought he was blinded by the sun but soon realized it was much worse. ‘Suddenly I couldn’t see the dials in front of me. It was just a blur. I was helpless.’ He gave new meaning to the phrase “flying blind.” Turns out he suffered a stroke. A pilot familiar with his airplane might know where the radio was located to issue a Mayday alert. And, how fortunate for this blind pilot that a Royal Air Force Wing Commander was in the air who could quickly fly to offer assistance from his aircraft.

Can you empathize with O’Neill? “We are struck, perhaps not with a stroke, but with relationship issues, a sick child, or a health issue. Not midair, but mid-career, mid-semester, midlife. We lose sight of any safe landing strip and, in desperation, issue our share of Mayday prayers. We know the fear of flying blind. During various pathways of life, it is easy to hear more than one voice entering our cockpit. One communicator says relax. The financial page forecasts a downturn; some financial writers are fear mongers promoting their solution for their own financial gain, even asserting double, triple or multiples of 10 to the size of your investment. Oh, the voices. How do we select the right one?” True?

Thank you for asking Nvest Wealth Strategies, all of us, to assist you with investing your life savings and “Living Life” wealth planning. Few clients “land on our runway” without guidance from a friend who experienced peace of mind by partnering with us. As I retire after investing client portfolios for 45 years including 17 years since founding Nvest, it is a fantastic privilege of trust you extended. We weathered our share of “rainy” days where there was not a forecast for sunshine; we were flying blind. Isn’t that so much of our flight through life? Do we really control every turn? No, it’s the bumps upon which we climb.

The pilot of the Cessna hit the runway with the commander’s voice of guidance, but couldn’t land. The same thing happened on a second attempt. It took the blinded pilot 8 times before managing to make a near-perfect landing. It’s easy to believe that he was ecstatic about his successful, safe outcome. No doubt his life was forever changed. The investment and financial planning path is often foggy before the sunshine arrives. It’s important to remember that we never travel life alone. We do not know what the future holds. But we must remember we are not alone. We are grateful to earn your trust to “land your plane.” Thank you! THANK YOU for allowing us this season to partner with you and your family.

-Bill Henderly, CFA, Nvest Wealth Strategies, Inc.

THE WEALTH FEEDBACK LOOP

Engineers often utilize feedback loops when designing control systems. A feedback loop is a control that integrates the system’s output back into an input stream to control future operations. Here are some common examples of a feedback loop:

- Your home’s thermostat: As the temperature drops below a set target, the thermostat provides input to the furnace to activate and warm your home. When the temperature climbs above the desired setpoint, the thermostat signals your furnace to turn off.

- A microphone sends an input signal into an amplifier/speaker and the speaker generates sound. If the microphone is held too close to the speaker, it captures the sound from the speaker and creates an unintended “circular” loop; this generates an unpleasant “squeal” we are all familiar with.

- The NFL draft: Every year, teams with the worst record are provided the earlier opportunities to select the best players coming out of college. As these teams “rebuild” with more talented players, they should eventually improve their win-loss record and move down in the draft (in theory).

In finance, the “wealth effect” is a type of feedback loop that influences an individual’s own financial decisions and actions. Home values are one area where the wealth effect can be observed. As home prices increase, consumers feel emboldened to increase spending even if their actual income and cash flow remain stagnant. This drives economic growth which supports home prices moving even higher. A positive (but unsustainable) feedback loop.

Investment assets can be another source of “wealth effect”. One can log-on to their 401K, brokerage, savings, and other accounts to see real-time account values. We can track and monitor wealth like never before. By contrast, one does not receive a fresh appraisal on their home daily (not even Zillow).

Economists are noticing a shift in the wealth effect for younger generations. Whereas the baby boomer generation prioritized purchase of a house and later built an investment portfolio, the average millennial is more likely to pursue establishing an investment portfolio for several years prior to purchasing a first home. Financial assets, rather than home equity, are a bigger driver of wealth for the millennial generation’s perception of overall wealth. As millennials begin to build and inherit more wealth, economists believe this feedback loop may alter consumer spending habits. As markets advance, the perception of wealth increases, which boosts consumer activity, which may further advance markets. Of course, the opposite can also occur. When markets retreat, wealth perception decreases, which may reduce consumer activity, which may in turn drift markets lower. Feedback loops can be self-fulfilling and amplify economic swings in both directions.

It is important to balance significant financial decisions with actual income and cash flow (not solely based on unrealized gains within their portfolio) to manage living expenses. It is unwise to rely on unrealized gains in portfolios to create a lifestyle which is challenging to sustain through the inevitable ups and downs of the financial markets. It could also explain why some behavioral economists observe younger generations may invest more conservatively (and sacrificing longer-term growth potential) than their parents might have at the same stage of life. Recall hearing the saying “act your wage”? Wise words to remain grounded and avoid becoming a victim of a noisy wealth feedback loop.

– Jordan Ranly, Nvest Wealth Strategies, Inc.

PORTFOLIO UPDATES & FUND CHANGES:

In early August, we swapped into a new, lower-cost share class of American Funds Bond Fund of America (BFAFX into ABNFX). The two symbols own exactly the same investments, but the new share class sports a lower expense ratio and results higher total return.

Secondly, we adjusted our international exposure via two new ETFs September. We believe international equities are attractively valued relative to domestic, and offer an important ingredient to portfolio diversification. In more aggressive client portfolios, WisdomTree Japan (DXJ) was added and owns Japanese companies that generate the majority of their revenues from exports. Japanese companies also appear to be gaining attention of value investors like Warren Buffett. In other client accounts, WisdomTree International Quality Dividend Growth (IHDG) owns companies that are growing their dividends; an attribute of quality companies and one investors appreciate in this era of higher interest rates. These active-ETF positions are also currency hedged, meaning they intentionally “protect” or reduce short-term volatility associated with currency change. These changes were funded by selling John Hancock International Growth, a no-load mutual fund with respectable long-term performance but which often pays larger capital gain distributions at year-end (not desired in taxable accounts). These new positions are a good “upgrade” to our international equity exposure.

-Steve Henderly, CFA | Nvest Wealth Strategies

Interest Expense Poised to Grow as % of Federal Budget…

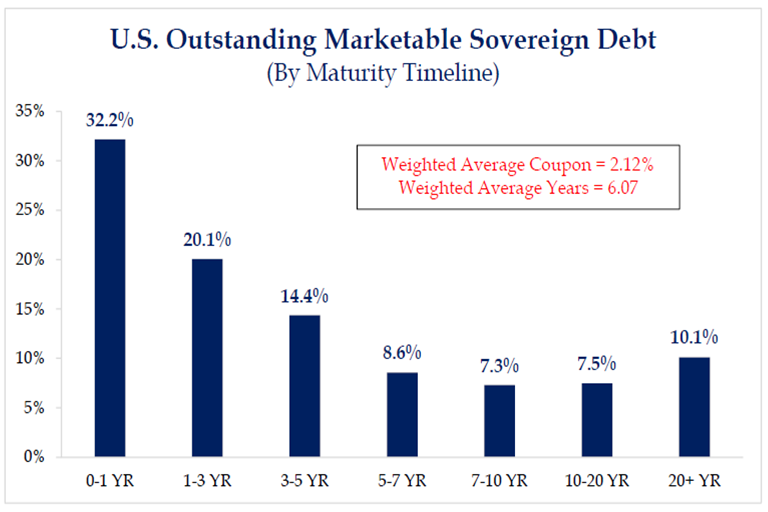

With more than 50% of all outstanding US debt maturing in the next 3 years and at a current weighted-average coupon of 2.12%, refinancing these liabilities in today’s interest environment will be decidedly more expensive.

Combine this reality with continued deficit spending by fiscal policymakers, interest expense is now 14% of the entire Federal Budget. It seems the word “austerity” will again become a more common part of our vernacular as financial markets force discipline to pay for government spending in real-time.