I carefully saved for most of my life… now you are telling me that I need to spend my retirement nest egg?

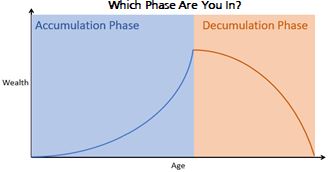

One of the most difficult transitions many individuals will face in financial life is moving from being a “person at work” (the accumulation phase where you are saving and building wealth) into someone now living off their “money at work” (the “decumulation” phase). A recent study by BlackRock Retirement Institute found that “instead of actively and systematically decumulating assets, retirees display a tendency across all wealth levels to retain assets and not spend down their initial principal.” The study also found that, “More than one third of current retirees actually grew their assets – leaving considerable potential consumption on the table.”

Decumulation is not simply an issue of knowing the numbers and the math behind your LIVING LIFE retirement plan; it also involves a change of mindset. We find most clients, regardless of how disciplined they were during their working years to build and grow savings, share similar questions and fears:

- Did I save enough?

- Will I outlive my money?

- Am I taking enough risk (or too much risk) in my portfolio?

- What happens if the economy or stock market “crashes”?

Capitalizing on these concerns, the insurance industry might submit the “best” solution is converting a significant portion of one’s savings into an annuity. The allure of a fixed annual income stream paid over your life might reduce the anxiety of outliving your assets. But we also know that annuities are not magic bullets, and the same income stream (or better) can be replicated via ownership of traditional investments; plus, they retain a higher probability that assets will be passed on to one’s heirs and estate. An annuity is generally not the answer.

Thankfully, those who engage with us in our LIVING LIFE financial planning process achieve a strong grasp on how their accumulated wealth can provide for their financial future. They feel more equipped and confident to answer their most important questions, and even facilitate discussion to dream “bigger” about wealth beyond their lifetime. Our goal is to deliver financial peace of mind and we believe that can be achieved through education and proper planning.

You saved all of your life for a “time” in the future; recognize that at some point the future will be “now”. Let us help you build a pathway towards retirement spending and give you confidence in your long-term plan, including with the unfamiliar – or initially emotionally uncomfortable – transition into the “living off your money” decumulation phase.

Doing Diligence

“I would just as soon expect a farmer to prosper in his business who contented himself with sowing his fields and never looking at them until the harvest, as to expect a believer to gain much holiness who has not been diligent about his Bible reading, about his prayers, and about the use of his Sundays,” (quote from Dr. J. C. Ryle, 1816-1900, Bishop of Liverpool). Believing the Bible or not, it does provide important thoughts about Diligence that are applicable to all aspects of life. Diligence is steady, earnest, and energetic effort; often behavior associated with a work ethic. We know from experience that success in any quest requires being diligent – “giving all diligence.” Success does not accrue to being idle through life; no autopilot. It is intense effort; doing with purpose.

Consider your successes – in music, mathematics, art, sports, and career. Enjoying a beautiful yard or flower beds – to be admired for their beauty requires a diligent daily effort. No effort results in weeds and other lurking dangers. Idle hands make for disappointments in time. Funny: a grandmother was asked on her birthday by her grandson how old she was. She responded that she was 49 and holding. Her grandson then asked, “How old would you be if you let go?” We cannot cease being diligent and find success.

One who follows a constant effort, being diligent and persistence in their undertakings will achieve marvelous success. As we begin the investment process for clients, we spend time doing diligence – looking at investment fund ideas (studying performance results in up/down markets, understanding the repeatable investment process, and how risk is managed). Diligence is ongoing; it does not end when an investment fund idea is made. Doing diligence requires ongoing monitoring that the investment process continues. Due diligence also involves continually monitoring the economic landscape and backdrop which influences tactical strategy – increasing risk or dialing it down. History also shares that long-term investment growth and success accrues to being in the market – doing diligence; being diligent.

Likewise, if a goal is growing your savings for a lifetime, we know it does not just happen. Not too often does one “fall into money” or win the lottery. Warren Buffett’s success develops from being diligent, doing over and over again, the saving of small amounts, and investing for many years and seasons (not selling often which incurs paying taxes that destroy savings). Amazing how long it seems to take to build meaningful savings, while a chunky withdrawal occurs quickly to diminish those efforts. Doing diligence requires discipline and persistence of effort while keeping a keen eye on the goal.