Many are asking, “what’s next?” given election stress is ending. Let’s start with a true story.

Kati Metro, 74, was hiking near Phoenix, Arizona when she fell, injuring her face, wrist, and hip. Rescue workers arrived by helicopter, and strapped her to a stretcher. Unfortunately, fierce winds caused one of the lines – intended to stabilize the stretcher and prevent spinning during its lift into the helicopter – to fail. As the horizontal stretcher was pulled upward, it started spinning faster and faster, like the runaway hands of a clock – over 170 rotations during the two minute ascent. Katie survived the ordeal, although she was dizzy for days. As horrifying as the experience was, it’s a bit of an analogy about how a lot of people feel right now. Seeing clearly with “20/20” vision is challenging this year. Too many big and noisy developments continue to alter most everything about daily life; we are fatigued by this yearlong dizzying experience. Identifying your focus is important, particularly in the world of investing.

A key question running through investors’ minds relates to whether recent market activity is just a positioning adjustment (in/around an election), or the market re-rating growth and recovery assumptions? Is recent noise (headlines) providing direction, or is the market signal (trend) good guidance? Simple answer: elections don’t change everything! Trying to say the election results will cause the market to do this or that is impossible to predict. The markets are smart, and react over time to election outcomes.

First, it’s important to recall our February commentary, “Red, Blue & You.” It shared historical evidence that one political party or the other was not the deciding factor on how the market performs. Returns were influenced by the underlying economic conditions. If one invested at the start of a Presidential election year, 10 years later the value was always greater. Amazing, in 19 of 19 ten-year periods since 1936, an investor earned a positive return. In 15 of those 19 ten-year periods the amount invested doubled; an original $10,000 investment grew to more than $20,000. There were no single ten-year intervals that experienced a loss from the original investment. Investment success depends more on the strength and resilience of the American economy than which party holds office. Important – stay focused on being invested!

Next, avoid noise (headlines). Recent headlines remind many of March – “France braces for economic suffering as lockdown returns;” or “COVID ravages rural America, sweeping through Montana’s plains;” or on Bloomberg Opinion; “Millennials & Generation Z would be wise to prepare for a lost decade in the stock market.” How about, “The US-China cold war is coming to financial markets?” Or, “Why the best GDP report ever won’t mean the economy is healed.” Do the financial markets listen to these ideas? In the short run, yes; long term, NO! Many emotional investors listen too; but shouldn’t!

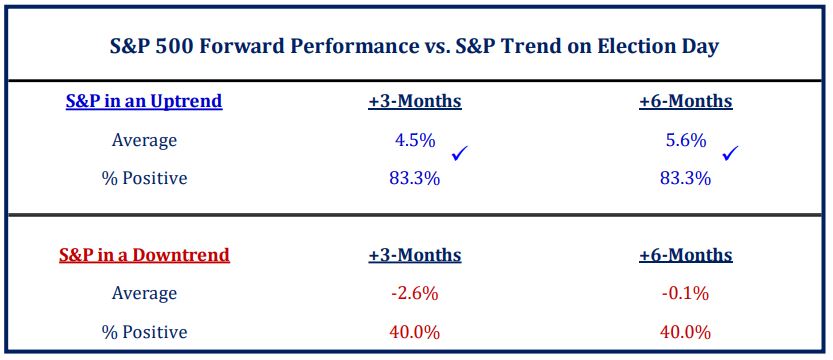

The market marches to its own assessment of underlying economic fundamentals, which is revealed in its signal (trend) displayed to investors. The current market signal, or trend, is up. That’s important this year. As much as one would believe an election outcome has massive consequences for stocks, the historical data suggests otherwise…whatever the trend of the market before the election tends to persist post-election. When the S&P500 is in an uptrend on election day, the next 3 and 6 months generally provide a positive return of +4.5% and +5.6%, respectively (that’s 83% of the time). If the S&P were in a downtrend, the next 3 and 6 months return is negative, -2.6% and -0.1%, respectively (40% of the time). In the past when post-presidential election markets experienced downturns, such moves related to deteriorating economics. That’s not today. The economy is showing growth and recovery from lockdown earlier this year, which many expect to continue irrespective of the election outcome. The market momentum continues upward. Market signal (trend) provides greater insight than noise (headlines).

Global and US news was worrisome for the markets during October. The stock market experienced increased volatility and declined -2.7% for the month after a -5.6% drop during the final/last week. As is often the case in the weeks prior to an election, the market worries about what it perceives as the worst possible election outcome for economic growth, this time a “blue sweep.” But the broader stock market trend remains up, rising +49.9% since the March 23 lows (was up +61.4% on September 2nd high). And, by October-end, S&P500 returns for the YTD were +2.6% (off from +12.1% on September 2). Client portfolios are advancing with the stock and bond market; they fully recovered early-year drawdowns from COVID lockdowns. Bonds continue to show a better YTD performance than stocks; but not since the March 23 lows. This is a somewhat rare experience. Stocks generate larger returns long term.

Recent market weakness and volatility is not fatal (but also not fun), and it is not the market re-rating economic growth. Looking deeper (macro clues) into the market action, markets dominated by high-priced “clicks” and “stay at home” stocks is now welcoming other players to the playing field; market participation is broadening. Cyclical sectors (materials and chemicals, machinery, industrials, autos, even regional banks; and small vs. large) are ending a multi-year bear market dating back to late-2017. Their advance means the US and global economic recovery is occurring. And gradually rising 10-year Treasury yields (interest rate) are echoing the perspective economic recovery is continuing; (could also signify concern for expanding debt levels from too much government deficit spending).

So, not all data is negative; skepticism is inappropriate. The “easy” economic gains are passing even as recent data still points to momentum. Growth rates for the economy should moderate – cannot jump another +30% from off the bottom – with parts of the service sector still looking fragile (travel, leisure & hospitality, small-business retail). Economic damage from COVID persists, and recovery will take time as a return to a “full” economy experience requires either 1) full reopening of the economy (including schools), or 2) the fiscal checkbook to reopen; or both. The lockdown was tougher on small than large businesses. Labor markets are healing a lot since May, yet there is much more recovery needed. It is very unlikely the US will pursue future widespread lockdowns without additional fiscal stimulus aimed at small business. Lockdown 2.0 would be more like a regional economic interruption (like from a natural disaster). Today, we know more about the virus, and treatment for it. Plus, we are likely closer to a vaccine or therapeutic that reduces health risk. These truths provide a promising outlook.

Also supporting a continued market advance is an aggressive monetary and fiscal policy instituted since late March. The money supply grew by an annual rate of +23%. That’s super-fast. With the economy not fully re-open and able to use all that new money, the excess filtered into the financial markets. That’s like rocket fuel to higher prices. Fiscal policy (spending) is the preferred choice going forward. Monetary policymakers are still lending to bridge the gap; policy will remain accommodative or easy as long as inflation remains tame. Post-election, additional fiscal spending stimulus should occur. The size of it is uncertain, but should provide another boost to economic growth and recovery into 2021 while virus issues evolve.

Third, longer term…Investors should monitor rising interest rates due to increasing amounts of government debt. While the 2010 decade required investors to get comfortable with Quantitative Easing (bond buying) by the Fed and other global central banks to boost the economy; this new decade may involve getting comfortable with the US and global governments pursuing large deficit spending and growing sovereign debt.

If/as the markets become uncomfortable with the level of government debt (and fiscal spending) inflation will enter the pricing equation – that would raise bond yields (lowering bond prices) and pressure valuations on stocks. It will be critical which path US fiscal policy pursues – economic growth to reduce government debt, or tax increases. The latter will reduce economic growth prospects and investment values. Simply stated, the USA could be at risk of abusing its “exorbitant privilege” as the world reserve currency as/if debt – fiscal (spending and trade deficits) and monetary (QE) policy – rises too much. There could be a day, somewhere in the future, wherein excessive deficit spending is the proverbial “straw that breaks the camel’s back.” The USA should not be excessive, or the last one with deficit spending pursuits. Presently, policymakers around the globe are uniformly committed to doing almost anything to create growth (following Lockdown 1.0) via deficit spending and accommodative monetary policies. Because money supply is growing (in excess of amounts needed to finance growth), US and global financial markets should advance to higher values.

The bottom line for investors: 1) the election outcome will not itself drive the direction of the market; 2) underlying elements continue to support the market’s advance and economic recovery; and 3) the concern over excessive government spending is for “tomorrow.” For now, keep watch; stay invested, and keep things in perspective.