Do you know, or ever meet, a Mr. Kadiddledopper? If so, you’d surely remember. He is a man of opposites. Kadiddledopper is a guy who lives in a small town, whose house looks badly in need of painting; yard needs mowing; landscaping is overgrown with tall weeds woven in; and a broken picket fence with peeling paint. Even his clothing announces a reclusive personality. The town folk don’t know how to relate to him. Mr. Kadiddledopper speaks in opposites. Understanding his talk is challenging and confusing. “Bye. Sure is cold today,” he says when greeting you on a humid 90 degree day. Caution when following his directions – turn left when he says go right; stop means go, and go means stop; up-town means down-town. When he answers “no,” he really means yes, but a most peculiar exception is “Yes” always means yes. Is there such a real-life person? Not sure; I created my fictious guy for humorous “fun” with young grandkids. Ever struggle with a toddler who says “no” to everything? Try instructing them that “no” means “yes,” and “yes means “yes.” You may still be frustrated and certain that opposites don’t work. “Don’t try it” with your spouse, and definitely not in public! You will discover it’s easy at first and gets harder with practice. [Italics will denote opposites to avoid confusion.]

January was a terrible month. NOT! The first month of 2023 offered one of its best starts to a new year. The S&P500 rose +6.3% and the worst performing domestic index last year, the NASDAQ, jumped over +11%. Since October 12, 2022 the S&P500 recovered +14.5% (still -13.7% below its last closing high on 1/3/2022). Client portfolios experienced welcomed recovery of value in both stocks and bonds. “Hey, stop it; we don’t like it!”

Seasoned investors understand that success often accrues to those who pursue the opposite – opposite of consensus and opposite of normal intuitions or feelings. Feelings can create major problems when fear captures the investment process; fear can wreck long term investment success by instructing one to get out when they should remain steadfast. Please keep in mind, that bear markets eliminate prior bull market excesses, AND transfer leadership. This bear market process is still underway.

Opposites are prevalent but are currently not yet widely pursued by the marketplace of investors. Let’s list several Kadiddledopper ideas existing in investment land:

- “Good news is bad news; and bad news is sometimes good news, unless it is REALLY bad news”. This interpretation appears in bear markets; opposite in rising bull markets where good news is good (and bad is bad). The current “bad news” interpretation may be starting to change with inflation slowing and the Fed slowing the rate of interest hikes.

- 40-year breakout (rise) in US bond yields offers the highest in 10 years (bonds provide yield again).

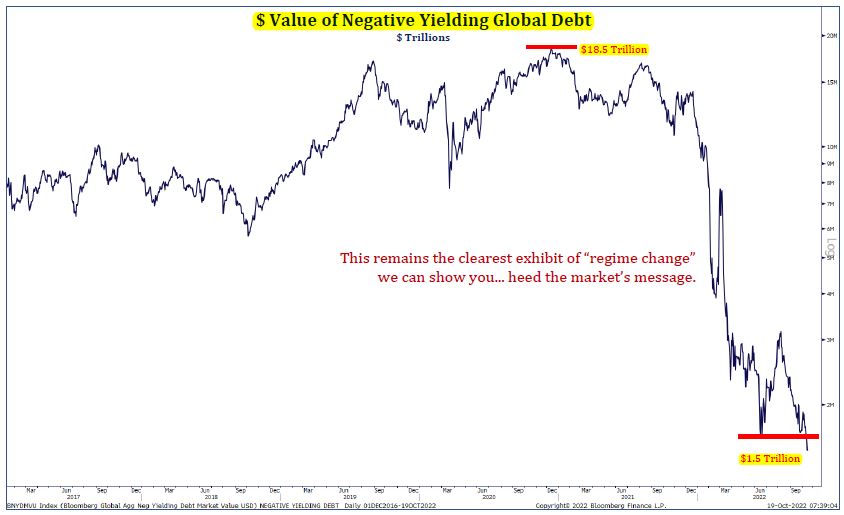

- No negative yielding debt today, unlike $18.5 trillion that existed in many countries in December 2020 during Zero Interest Rate (ZIRP) policies.

- Foreign countries are selling US Treasuries and US dollars; that’s opposite of recent past buying activity. As the US dollar drops in value relative to many foreign currencies, US companies with large foreign sales revenue are outperforming those with zero foreign revenue – up +30% vs +11% since 10/12/22, respectively.

- The largest 5 stocks (FAANG+) by market cap dramatically underperformed from 10/12/2022 thru early January; but they are recently “rebooting”. We expect that to fade. Equal-weighted S&P500 is beating the cap-weighted S&P500 significantly.

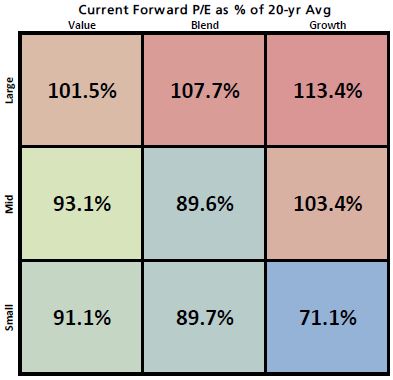

- Value-style stocks are creating multi-year high returns relative to growth (during 2022 bear market decline, value slipped -6% vs -30%; and since 10/12/2022 value advanced +15% vs +11% for large growth).

- Foreign stocks returned +31% vs 14.5% for the domestic S&P500 index; international stocks offer better valuation than domestic, even after their recent strong performance.

- Labor markets are still tight/hot even after two gang-buster years. But because of inflation, real income is negative. US consumers appear near exhaustion with savings rates declining and credit utilization rising; creating affordability/consumption issues – inflation is “eating up” wages/earnings.

We are skeptical that the current rally is the start of a new bull market because the Fed is still raising interest rates to continue its fight on inflation. Bull markets start with big jumps upward; not yet the experience. The current trend (churning, or up/down/up) of a bear market is still underway. Progress battling inflation is developing as some components are declining from their peak last fall. But several sticky components – wages, rents, and food – will be slower declining to desired levels because the labor workforce is still too tight/hot.

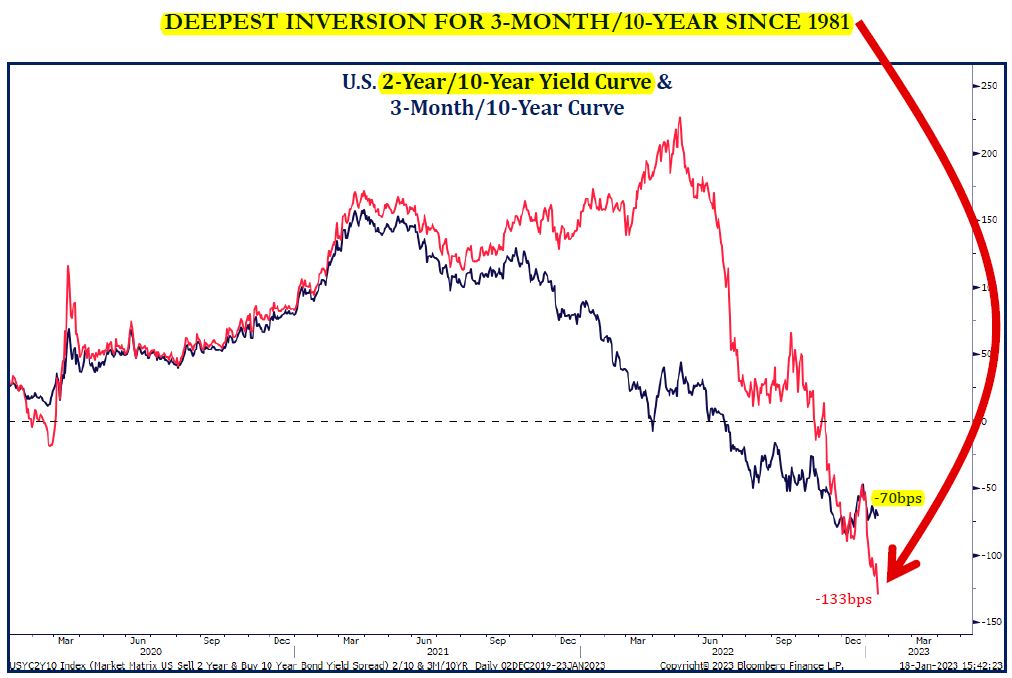

Monetary policy always affects the economy with a lag making it difficult for central bankers to know the real impact of policy tightening for 6 to 9 months into the future. Recent high inflation and a deeply inverted yield curve (wherein short rates are abnormally higher than long rates) signify a prior monetary policy mistake. History shows that stocks do not normally make a sustained rally with an inverted yield curve. The average rally during curve inversion is +10% to +15%; there were two instances of +25% rallies (1980, and 2006-2007). We are presently at the upper end of what is typical.

History shows that stocks do not normally make a sustained rally with an inverted yield curve. The average rally during curve inversion is +10% to +15%; there were two instances of +25% rallies (1980, and 2006-2007). We are presently at the upper end of what is typical.

Many investors still appear to be looking in the “rearview mirror”. If bear markets eliminate prior excesses AND transfer leadership, it’s ironic that so many investors spend time & capital attempting to time re-entry back into old winners instead of identifying and embracing new leadership. Also perplexing is market action by bonds, stocks, and gold. None believe the Fed will stay tough in its approach to fighting inflation. Many investors believe a “Goldilocks” outcome will occur. They expect the Fed will get “weak knees” or get soft in fighting inflation when employment weakens. Further, political pressure will likely mount on the Fed if/when a widely expected recession develops. But other asset classes are saying something different – gold is making new highs because of worry about inflation and interest rates remaining higher than expected. Copper, an early economic indicator, is rising while oil is sliding due to worry about a recession. These are opposite opinions. Which is correct? That’s what happens in bear markets. Confusion exists about yesterday leaders vs new.

A few criteria should unfold to allow a sustainable rally to become the next new bull market. We need: 1) inflation expectations to re-anchor at lower levels; 2) valuations for stocks to drift down closer to levels associated with bear market lows; 3) and organic drivers of economic growth to exist that pull investors back into the market. This also includes better understanding of government policy direction for 2023 and 2024.

Did you know? About 50% of US outstanding government debt matures in the next 3 years; and the weighted average coupon is 1.83%. The current 2-year Treasury Note yield is over 4%, making an increase in Federal interest expense appear inevitable. Progress on reducing the federal deficit could be challenging with interest rates likely to stay elevated. Further, about 60% of US government spending (for Social Security, Medicare & Medicaid) is indexed to inflation. COLAs for Social Security’s 66 million recipients is +8.7% for 2023. Mr. Kadiddledopper claims “policymakers are serious about the country’s long-term fiscal health!” But until they truly are, this upcoming issue could create volatility and market uncertainty during the spring and/or early summer.

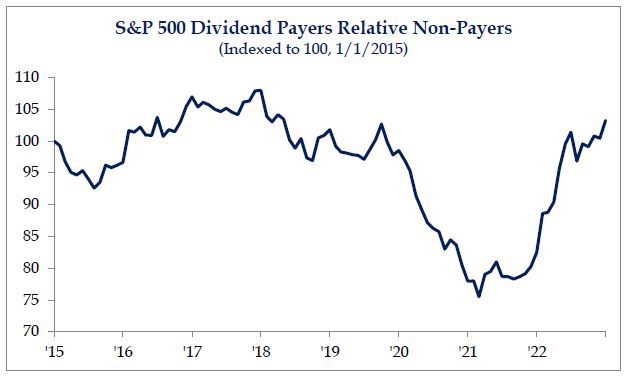

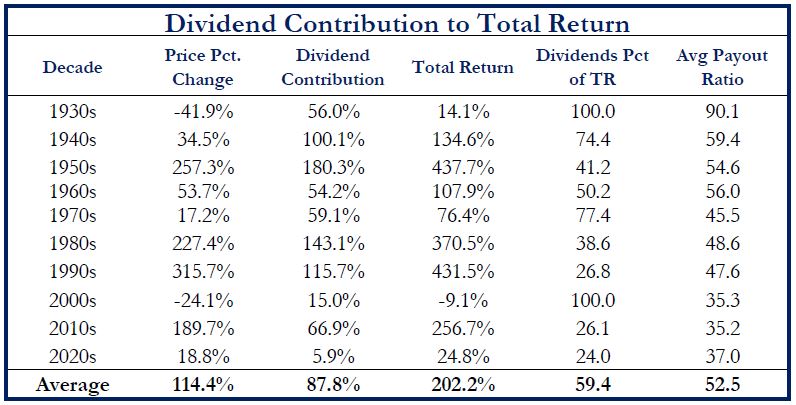

Valuation is always an investor’s biggest decision point when choosing one investment over another. Exuberant (rich/expensive) investments are seldom long-term winners; often where a majority feels “comfortable.” Alternatively, the exasperated (cheap/undervalued) opportunities generate exciting return experiences but they can feel “uncomfortable.” Currently, assets that provide opportunity include: 1) Bonds offer the best valuations in years/decades, and aid diversification efforts; 2) International stocks look better than domestic stocks (especially large growth); and 3) Value-style is attractive versus Growth. A key characteristic is owning investments that provide return of capital (cash) to investors. Growth-style stocks generally do not. With interest rates and bond yields likely to remain rewarding, dividend paying stocks also appear attractive. Dividend contribution to total return (TR = price change + dividends) was low during the 2010s and thus far in the 2020s at about 25%. Historically dividends provided about 60% of total return . Investors are starting to desire current dividends over expectations for future growth (see both chart and data table below).

Valuation is always an investor’s biggest decision point when choosing one investment over another. Exuberant (rich/expensive) investments are seldom long-term winners; often where a majority feels “comfortable.” Alternatively, the exasperated (cheap/undervalued) opportunities generate exciting return experiences but they can feel “uncomfortable.” Currently, assets that provide opportunity include: 1) Bonds offer the best valuations in years/decades, and aid diversification efforts; 2) International stocks look better than domestic stocks (especially large growth); and 3) Value-style is attractive versus Growth. A key characteristic is owning investments that provide return of capital (cash) to investors. Growth-style stocks generally do not. With interest rates and bond yields likely to remain rewarding, dividend paying stocks also appear attractive. Dividend contribution to total return (TR = price change + dividends) was low during the 2010s and thus far in the 2020s at about 25%. Historically dividends provided about 60% of total return . Investors are starting to desire current dividends over expectations for future growth (see both chart and data table below).

Ever notice how many times life experiences or events turn out opposite of what was expected? Investing is like that too. Opposites are everywhere, always. The time to uncover changing themes is during bear markets when excesses are corrected. That is how we are tactically investing in this environment.

How would you react to the fictious man of opposites, Mr. Kadiddledopper? “No” means “yes”; and “Yes” means “yes!” “Please enjoy a bad day!” [Not!]. Thanks for sharing some humor. It’s good for our mental health.

Bill Henderly, CFA | February 6, 2023

Click here for the Printer-Friendly PDF version, including Market stats