I am hopeful this will be a final Market Alert relative to the past few weeks of hysteria, fear, and market turmoil. The market spoke loudly yesterday (Thursday, March 12th) as it blasted on all areas of the financial markets – gold, bonds of greater risk orientation, and stocks around the world. We are hopeful recent action was the capitulation event for the market forming a bottom – it never feels like the bottom near the bottom. Time will tell. We do not know, we cannot model how Coronavirus will evolve and/or how it is minimized. We expect Washington will deal with the public erosion of confidence being expressed in the economic and financial markets both here and globally.

Thus, lets share two points of focus about the future, what we, Nvest Wealth Strategies, are looking for and what we are doing as we talk with clients and manage their investment portfolios. As when cooking food, if you don’t follow a recipe, it does not turn out well. This writing has two components: important Washington policy action and portfolio management recipe.

Here is what we are doing – the Portfolio Management Recipe: Take advantage of what is happening in the financial markets – we are taking action with great care.

- This means continue, do not alter your current investment objective (stock/bond mix). Chosen in a day of rational thinking based upon your time and purpose, your portfolio is invested in a “buckets of time” concept that provides time to weather any financial market drawdown.

- In Personal brokerage accounts, identify and capture losses, if/where appropriate, to offset already captured YTD gains. Why pay capital gains taxes next year, when capturing a loss can wipe out future payment of taxes? Thus, we will be harvesting some losses in funds we still like, to eliminate realized capital gains, AND maybe even capture additional losses to use against future years when gains are realized (or distributed from the funds). Note: this is not relevant for IRA accounts.

- As losses are captured, we will reinvest back into like-kind fund/ETF choices so that when and as the market rebounds (which it will), recovery of portfolio value will occur more quickly (you do not want proceeds from these actions to move to cash; it’s like jumping out of the basement window, or an airplane which may already be on the runway and could take-off).

- Bond allocations are doing their part in “Buckets of Time” portfolio management. If/as money is paid from IRA or Personal accounts as part of “Living Life” plans, bonds are a great current source of money as they 1) held up, and 2) remain THE most expensive asset classes in all client portfolios. They also represent an overweight exposure relative to the Investment Objective (stock/bond mix), as stocks most always take the brunt of market drawdowns. In most every client portfolio, between Cash (money market funds) and Bonds, there exist years of money available to weather the current financial market situation without need to sell stocks at this time.

- Market drawdowns provide opportunity to prepare for the future. We will be monitoring very closely how governments, particularly the US fiscal and monetary policy responds. This is most critical to how we might make tactical exposure changes from the current “risk dialed-down” strategy – will value begin to perform better than growth; will small show rapid rebound from deeply oversold conditions; and etc.?

- If you were holding a lot of savings at the bank, excess to what is needed for “LIVING LIFE” at the bank (meaning longer-term money), consider moving it into your Personal brokerage account to take advantage of owning “on-sale” growth investments.

Here’s what we are watching – the Government Policy Action Recipe: A “full-court” press that is not party politics MUST occur now (we are watching for significant policy response).

The market rout/decline on March 12th in particular, was advanced by a collective leadership weakness in Washington. Neither the President nor Congress is responding with an all-out, flood-the-zone, bazooka effort. As someone said during one of the great world wars, “there are no atheists in foxholes.” The same should be true with government – there is no place for party politics in hysteria or crisis. Their wimpy approach to stimulus (and crisis management), if not quickly adjusted, is likely to create a longer recovery. Their effort should be super aggressive, an overwhelming response to deal with health concern AND economic and financial consequences affecting everyone. This should include tax cuts, greater spending (even though current deficits exceed $1 Trillion), regulatory easing on banks (particularly on those that maintain liquidity to/in the financial markets), a cut in tariffs – all actions pursued to stimulate the economy. This also presupposes that the Fed will quickly cut interest rates another 50 basis point, and then another 50 basis points shortly thereafter, to zero. There should not be the current double fear and hysteria because of health and financial uncertainty. Market expectations are VERY high; the stock/bond market will be the vigilante that forces an appropriate policy response. Responding quickly will provide a “V” shaped recovery, instead of other undesired letter alternatives – like a “U”, or a “W”, or a dreaded “L”. The country does not need prolonged economic distress while finding cure for Coronavirus. These twin-events (virus and economy/financial markets) must be treated as a “world war.” We all know, no one does war better than the USA.

We (Nvest Wealth Strategies) do have a proven recipe that is tested and works. Our process is repeatable; it is disciplined; and attempts to be unemotional even when most all of us are understandably lacking clear vision for the future. In over 40+ years of professional investment service, there were many market drawdowns, including October 1987, 2000 to 2003, and 2007-2008. The recipe being shared above works – saves taxes and keeps investments in place; and portfolios will be poised for an inevitable rebound that will occur. No one knows when or how it will begin, yet it will, and investors must be invested to experience recovery.

We are here for such a time as this. Thank you for sharing your worries, and also sharing your confidence in how we are providing help to you.

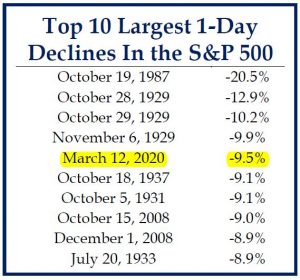

PS: by chance you would like to see how yesterday ranked in history for bad 1-day market declines, below are those 10 worst days in the US stock market.

We survived March 12th; we survived the drawdown since February 19th (last S&P500 high). Let’s experience the next, future highs the market will achieve. Experiencing the future requires following a proven recipe and being invested for the long term.