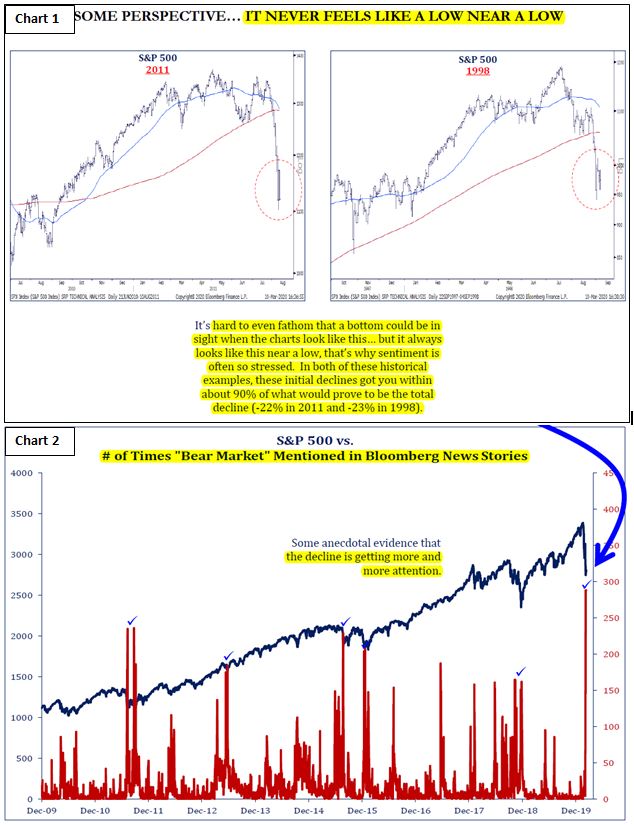

To start, one should read this following thought several times: “It never feels like a low near the low”.

Market Stress is absolutely no fun. After all these years (over 40), market drawdowns are terrible and bewildering; confounding one’s ability to comfort others when no one knows the future. We can review history (a lot of examples) to offer perspective, but providing certain future direction is not possible. We are all in it together.

The longest running Bull market in US history is ending. For the Dow Jones Industrial Average, as of March 11th, it declined and closed -20.3% since its last high on February 12th. The S&P500 will conclude its 11-year bull market run, March 12th; entering today it was down -18.96% from its February 19 high.

Let’s offer some brief comments relative to this very fluid time for investors and clients:

- “It never feels like a low near the low” (see chart 1 below) – it is always hard to fathom that a bottom could be in sight when the market is dropping like a brick and headlines are dire. It always looks like this near a low; that’s why sentiment is often so stressed. Usually, initial nasty drawdowns move about 90% of what proves to be the total decline. The markets look washed out; climactic in their action.

- The velocity and magnitude of the current decline only trails the October 1987 and October 2008 declines (15-day rate of change). Sentiment is stressed.

- The market does not discriminate between a recessionary and non-recessionary decline. The average bear market decline in non-recessions is slightly less drawdown than during a recession (-23% vs. -25%).

- The bottoming process requires a combination of more time and more volatility (not fun). Will there be 3 components to this market decline…1) Virus and bond yields (dropping); 2) Saudi/Russia and Oil (Putin saw a world in turmoil and decided it needed more); and 3) perhaps the tide going out on a leveraged player (country?) or company/industry (oil?). Either way, sentiment is moving lower (could say, moving the right way to achieve a bottom)

- Bear market “talk” is rising quickly – approaching 300 times in financial press in recent days (chart 2 below)

- Travel restriction – Last night President Trump addressed the nation to discuss government’s efforts to respond to Coronavirus, including shutting down travel from Europe for a month. Additionally, the House of Representatives is moving on legislation to respond also. There is real health and economic pain associated with fighting the virus. [I hope Washington is not too caught up in politics that it fails to understand the health and economic impact of what happens.] Financial markets will continue to be the vigilante to force more urgency in Washington; markets are no respecter of party politics in times like this! And, presently they are screaming that not enough is being done. Further, the remains little or no clarity around how long this may last.

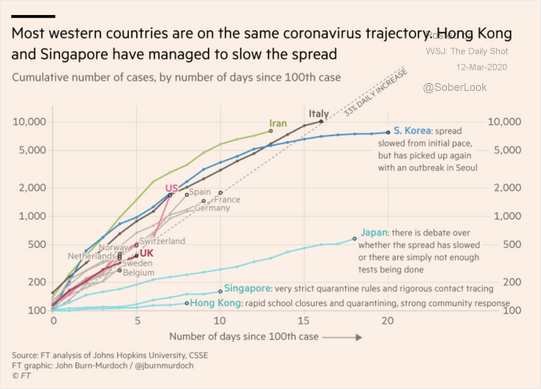

- Coronavirus Conference cancelled because of ….Coronavirus. The incidences of the virus is traveling similar time and frequency paths, looking at country to county (see chart 3)

- NBA basketball season suspended indefinitely; rumor the NCAA March Madness basketball tournament is uncertain

- Colleges suspending classes for weeks; online classes continue

- Spring football games at OSU & Michigan, are now cancelled; others expected as well.

- US economy was doing well, through February. Slow response by Washington will likely lead to softer conditions. The Fed monetary policy is more immediate; rates will be lowered again; but their tools will seem less effective. Congress must enact fiscal policy to address the virus and the US economy. The markets will extract action from governments – US and foreign.

Briefly, let’s review a most important concept about managing your investment portfolio. We describe portfolio management as “Buckets of Time” investing. This process entails owning 3 different buckets of time in every client portfolio. When we began investing for you, we reviewed how cash and money market funds are held for money needs known or anticipated over the coming 12 months (money at the bank, savings accounts, and even at Schwab); bonds should be utilized for money forecast as potentially needed over the next 2-5 years; and stocks are the best vehicle to both grow and battle one’s enemies of inflation and taxes to provide for longer-term needs/objectives 5+ years or more in the future. Most important, these buckets of time, if thoughtfully and realistically applied to each portfolio’s time horizon and purpose, provide each investor the power to persevere through any market storm.

In closing, we acknowledge environments like these are extremely challenging. They are powerful in their ability to cause any investor to question their approach and believe no end is in sight. Fear extraordinarily powerful. Most important in these storms is to be mindful of the reality that there is already so much bad news already priced in – including the expectation for even worse headlines to come – that even a little good news can quickly lead to a positive reversal higher.

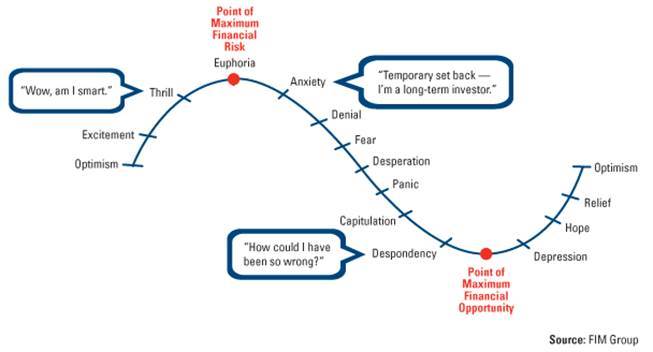

One must control what they can. Successful investors remain keenly aware of the cycle of market emotions (referred to at the top of this note), unemotionally assess whether their own time horizon has changed; and proceed accordingly which in most cases is to carry on.

Two final thoughts, offered from a very personal perspective…

- Years ago when I started (1976) my investment career, I was guided to avoid too much discussion about politics and religion when visiting with clients. I am respectful of other folks’ beliefs and views.

- Politics must be put aside – Congress and the White House must come together for its citizens and their health; the country and its economy; and its leadership in the global big picture. Presidential election year politics must be sacrificed for a higher ideal.

- Most important, during times like this, I am confident that the Creator of this world is still in charge of this world. He knows the future, and will bring healing and restoration to current virus health issues.

- All will ultimately be okay!

Bill Henderly, CFA | Nvest Wealth Strategies, Inc.