We occasionally hear this idiom: “There is more where that came from.” It can be used in a negative, combative sense or in a positive, generous way. The statement may be offered to a belligerent child – “if you do not shape up, there’s more to come.” Alternatively, where there is strong achievement more success often follows. In both cases the meaning is the same: there is a reservoir just waiting to be tapped if needed. Another famous statement: “the barrel is only half full; or the glass is half empty.” As we pass through 2022, will there be more market advance (from which it came), or are investors expecting the success to evaporate? Is the longer market up-trend still viable, or are the short term worries about “everything” (inflation, interest rates, Russia/China/North Korea, oil, COVID variants and living life again) emptying investor sentiment? How much more is to come – plenty more (of what)?!

Market action in January was volatile on a downward path. Does it feel like investing is akin to climbing stairs one step at a time; and when not doing well, it’s like riding an elevator down? It takes longer for values to rise than how fast they seem to decline. Everyone predicted higher volatility in 2022, but the declines in January exceeded expectations. January closed with its worst month since March 2020, as expectations for higher interest rates and Quantitative Tightening (QT) eroded investor confidence. It almost appears like a deserted western ghost town – where did investors go? Thank volatility for reducing investors’ clarity and enthusiasm. The S&P500 retreated -5.2% for the month; but was down from the January 3rd high to January 27th low -9.7% (the last two trading days of the month recovered +4.4%; that’s volatility). During this same stretch, the NASDAQ lost -15.7%; with many stocks declining more than -20% since making their last closing high in 2021. While 10 of 11 sectors retreated in January, only energy produced a positive return. Market volatility produced big up and down days with sharp intraday reversals; extreme volatility so far this year. Is there more to come?

Client portfolios are still tactically mixed for continued economic growth, albeit growth is expected to slow from the torrid pace following the Great Lockdown. All markets rose quickly from March 23, 2020 due to super-fast money supply growth (fiscal stimulus), plus zero interest rates and Quantitative Easing (QE) from the Fed and other central bankers. Now, government stimulus is largely complete – it’s not needed when there are more job openings than unemployed. The market rose with the “wind at its back” in 2020 and most of 2021, but now faces a “headwind” as future market advances will be determined by company growth and profitability. During January, all portfolio objectives followed the market direction as a “risk off” orientation progressed. Both stocks and bonds lost value.

Asset values declined due to accelerating concerns about inflation and moderating economic growth. History shares that economic growth cycles end with excesses – inflation, tightening monetary policy, and/or high or rising taxes and new imposing regulations. Policy mistakes kill economic growth cycles. It’s not the first interest rate increase that hurts; it’s the subsequent hikes and ultimately the last one that is the problem. Central banks tighten until something breaks (usually the most highly in debt). Interest rates are to the financial world what “gravity” is in the physical world. High rates will ultimately slow economic growth.

We are well aware that monster government stimulus plus supply-chain and labor shortages created the biggest inflationary rise in over 30 years (1982). Inflation is running hot and is likely sticky because of both demand and supply shocks; supply shocks relate to both product and labor being low compared to demand. Now, the Federal Reserve and other central bankers are behind the curve (market bond yields). The Fed is currently ending QE (buying bonds which are stimulus) before they begin raising rates in March. They should end QE and initiate QT via raising interest rates. Because current rates of inflation are unusually high, the first Fed rate increase could be 0.5%; faster and bigger than usual to make a statement. Again, it’s not the first rate hike that hurts; it’s the last one (the market will tell of trouble as it approaches). And 2022 is all about rates – starting to rise in March, and more to come.

How “sticky” are currently high inflation rates? Was inflation due to policy mistakes? Several examples:

- The Great Lockdown, deemed appropriate during a global pandemic, created a great supply/demand imbalance. Historically, the ratio of inventory-to-sales hovers around 1.5, or more inventory than sales by 50%. Yet, the Great Lockdown curtailed production of everything. Government stimulus boosted demand wherein the inventory-to-sales ratio dropped to 1.0 and probably lower; plus the delivery of product was encumbered. Result – not enough supply for demand, resulting in rising prices (inflation) everywhere.

- Legislating wage increases during a recession creates inflation and ultimately drives real worker pay down (not up). To explain: when labor supply (unemployment) is high, greater than demand, legislating higher wage rates is inflationary. Worker pay increased +4% last year, the fastest rate in two decades. Most wage increases occur at best annually, but are sticky. Wages push up prices of products/services more quickly, and ongoing. The result is real wages (after inflation) are actually negative – wages do not keep up with inflationary price increases, especially for lower-income consumers.

- Shutting down pipelines creates a scarce commodity (energy) wherein supply constraints paired with high demand push prices higher. Add Russia/Ukraine geopolitical issues, and oil supply/demand rules are trapped; oil inflation is another “tax” for everyone! [Ukraine is also a large exporter of wheat.]

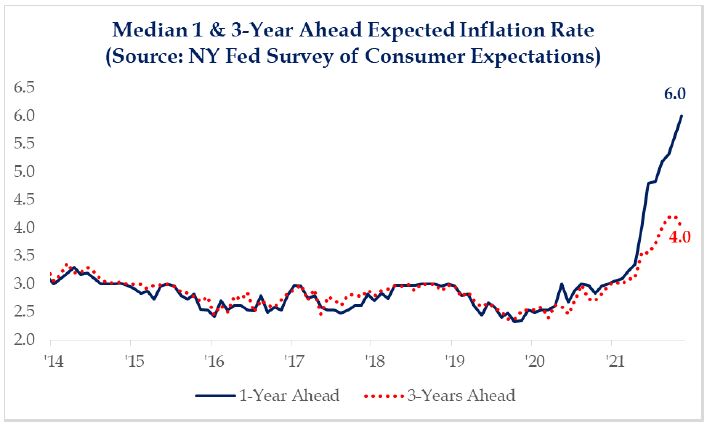

Supply is the enemy of price – too little supply boosts prices (inflationary). Inflation ratchets-up all prices to a higher floor. Inflation will not peak until after supply-chain and labor bottlenecks peak. Supply-chain bottlenecks will not peak while governments are still imposing rolling lockdowns due to new COVID variants. It seems more governments are arriving at the perspective that COVID will be a way of life, like the flu, and we must adjust to it and move forward. Inflation expectations for the year ahead are expected to be 6.0%. The 3-year forward data suggests lower inflation expectations at 4% down from 4.2%. It’s still probable that demographics, automation and globalization for supplies will keep long term inflationary pressures down.

Again, 2022 is the year of interest rates; it’s all about rates. As a result, markets will continue to exhibit volatility – concern for how much, how fast interest rates will be raised to contain inflation, and if increases will be too much for economic growth to slowly advance. Geopolitical issues will continue to test governments’ resolve and investors’ sentiment. Add that 2022 is a mid-term election year, where domestic markets will deal with that uncertainty as well. 2022 will likely provide pullbacks and a correction, providing a “pause that refreshes” or opportunities to enter the stock market at a discounted price.

Investors should maintain their investment objective (stock bond mix) because it was set for the long term. We are tactically adjusting portfolios to focus on shorter duration assets – both bonds (higher quality), and stocks (meaning dividend paying stocks with more attractive valuations). Long duration assets (like “FAANG”, Cryptocurrencies/NFTs, publicly traded private equity stocks, and SPACs which lack liquidity) possess greater risk; that’s because they generally do not pay interest or dividends so the total return depends on price change only. As rates rise, shorter duration assets with a relatively predictable cash return or payout, perform best.

The new bull market is now 22 months old. That’s young. Recall the average bull market runs 60 months; the last one ran 132 months. That advocates “there is plenty more” to come. But only to those who remain long term investors. We will use care to monitor the “year of rates”, and keep a careful watch for policy mistakes.

What are your current investment thoughts? Is your time horizon getting shorter, or remaining fixed? Psychologists believe the Fear of the Unknown (FOTU) may be the fundamental fear underlying all anxiety, the one fear that rules the rest. It’s difficult to maintain normality when things hang in the balance while you are waiting to see how worries turn out. Benjamin Graham, deemed the father of investment analysis, said (in 1963): “In my nearly 50 years of experience in Wall Street, I found that I know less and less about what the stock market is going to do, but I know more and more about what investors ought to do. You ought to 1) put the market’s recent fluctuations in long term perspective (markets generally rise more than fall), and 2) recognize what kind of an investor you are matters more than which investments you own” (be a ‘Rip Van Winkle’ investor = time in the market). Pessimism among consumers and newly bearish sentiment from investors are, in fact, bullish signs