Why does price change everything? When product and service prices are rising, there is a point when buyers diminish. Economic value ceases to exist. That is, unless the item is very critical to meeting important needs, then higher prices know no upper bound. Take oil prices – rising too quickly curbs driving habits; some businesses tack on fuel surcharges. If the price rises too much, then alternative product or service choices may be pursued (again with oil prices – one seeks alternative transportation options – bus, fuel efficient car, or electric vehicle); or other competition enters the picture wherein more supply promotes prices to slide. Shortages can cause prices to rise, often in huge ways. Currently, shortages of computer chips exist because of supply chain and transportation challenges.

Price is critically important when investing too (high price at wrong time = low returns). Investors always compare various asset valuations (price) to determine which offers better reward prospects. For years, valuation comparison between bonds, real estate, and stocks point many to the TINA factor; meaning “there is no alternative” or no better choice for return potential than stocks; stocks are the current TINA asset class. The cost of money since 2009 (interest rates) is so low that “cash is trash”, and recently Bill Gross (former bond king of PIMCO) stated that bonds are “investment garbage” amid low yields (expensive price and provide little in return). One economic research writer penned the “cost of money acts as gravity in the world of financial physics.” Low interest rates anchor returns low; rising interest rates boost returns to a point, then hurt; taxes consume all returns to lower net levels.

The last several statements are intriguing and thought provoking. Interest and inflation rates, taxes and government policy are of great influence. When the Fed maintains low interest rates to stimulate the economy and boost employment, cash and bond yields are kept low; returns are fixed at low levels. Stocks that provide variable returns offer an opportunity for better returns; that’s why they are viewed by investors as TINA. But, when the Fed begins to unwind accommodative monetary policies – either because the economy is strong growing naturally on its own; or because inflation is becoming sticky; or both – fixed returns in the form of cash and bond yields rise. As long as interest rates stay reasonable, businesses and consumers will remain comfortable to finance their purchases (plant, equipment, cars, and etc.). But if rates rise too high – often because of inflation expectations – then spending is curtailed and economic growth stalls. The same can occur by raising tax rates on corporate profits or investment gains. High tax rates will reduce profits (business and investment gains) and lower realized returns and the valuation attractiveness. At present, the US and global economic system is flush with money, more than it needs to finance economic growth – that excess continues to flow into the financial markets, and into stocks in particular (TINA).

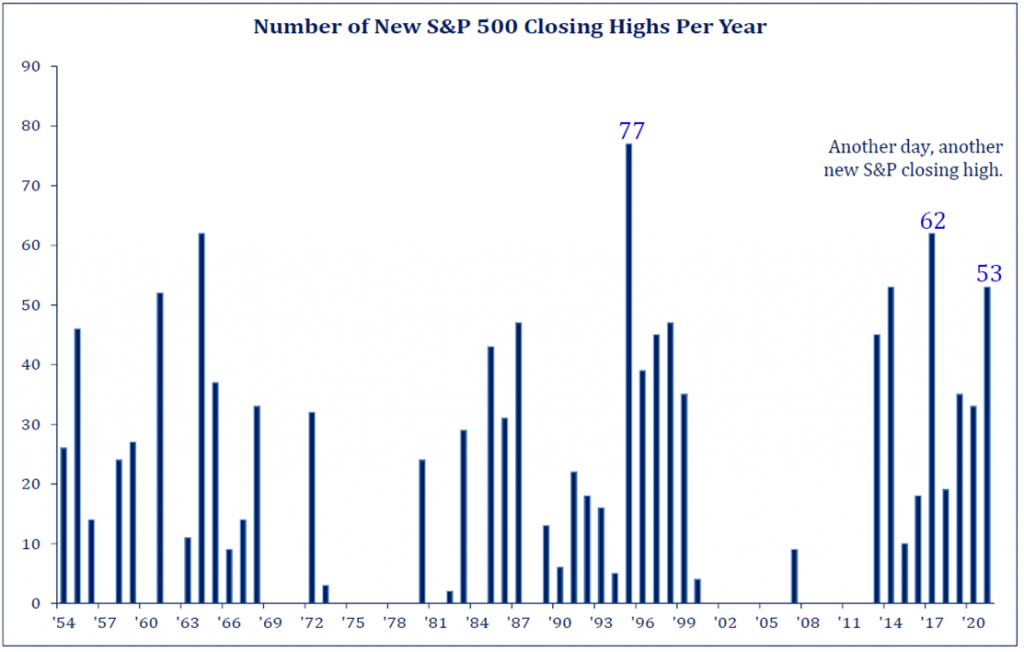

The S&P500 (stocks) added another +3% in August to boost the YTD return to +21.5%. That follows the 2020 full year return of +18.2%. Since the market low on March 23, 2020, the S&P more than doubled, rising +107.4%. Why? Because of the huge stimulus boost of money into the system that was not needed to finance economic growth; M2 money supply grew in excess of +30% over the last 16 months (that’s BIG). The YTD return through August ranks 5th among the best since 1950, trailing only 1987 (+36.2%), 1975 (+27.7%), 1989 (+26.5%) and 1995 (+22.3%). And during these 8 months, the S&P500 produced 53 new market highs; looking back to 1950, only 1995 (77 new highs) and 2017 (62 new highs) produced more (see chart to right).

the market low on March 23, 2020, the S&P more than doubled, rising +107.4%. Why? Because of the huge stimulus boost of money into the system that was not needed to finance economic growth; M2 money supply grew in excess of +30% over the last 16 months (that’s BIG). The YTD return through August ranks 5th among the best since 1950, trailing only 1987 (+36.2%), 1975 (+27.7%), 1989 (+26.5%) and 1995 (+22.3%). And during these 8 months, the S&P500 produced 53 new market highs; looking back to 1950, only 1995 (77 new highs) and 2017 (62 new highs) produced more (see chart to right).

Client portfolio returns are deriving benefits from the recent government spending efforts and economic rebound. The market trend is up, but presently, momentum (sentiment) is softer. As we wrote last month, peak “good as it gets” economic data is now, and is expected to become softer as the cycle matures off the bottom. Investors know that stocks lead the economy by 6 to 9 months – stocks jumped higher while the economy was still locked down. That resulted in high asset valuations for stocks, and everything. Now, the economy is unlocked and recovering, so valuations are returning “to earth” (from “otherworld” levels) to provide opportunity for this young 17-month old bull market to run further. Momentum is softer with fewer names (growth stocks that continue even with slowing economic stats) taking the market index higher. We see this occurring too from performance of different no-load mutual funds and ETFs in client portfolios. Growth is again beating value and cyclical sectors after lagging in the first 6 months of the year.

The overwhelming consensus that developed early this year around a cyclical recovery and reflation (higher interest rates, copper, crude oil, small cap stocks, etc.) appears flushed out at this point. Due to peak data everything, government transfers rolling off/winding down, supply chain and transportation concerns, COVID Delta variant, and potential sticky inflation, there is worry that the economic backdrop will soften. As stock market valuations are full, even rich being above pre-COVID levels, the market may be vulnerable to a pullback. Thus, while the trend is still up, momentum and sentiment is softer, with churning and rotation below the surface of the indexes. Nothing changes sentiment quickly quite like price (price changes everything).

This month, September – often a weaker performance month in the typical year – several political challenges may show an effect on the US markets: the bipartisan infrastructure package; an additional $3.5 Trillion spending budget with taxes; a potential government shutdown and debt ceiling; and the reappointment of Fed Chairman Jay Powell. Peak data plus an environment of policymakers creating new rules could provide a market pause that refreshes. Tax policy changes are important to monitor. [Some say October is the worst performance month of the year. That may be due to its history of some bad market tumbles. Mark Twain wrote, “October: This is one of the particularly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”]

Long term investors should always remember – “time in the market” is important. Time is every investor’s greatest ally, and dictates the importance of staying disciplined in pursuit of your investment goals. 2020 (COVID surprise and economic lockdown) and YTD 2021 (continued and uninterrupted advance despite historical parallels suggesting bumpiness) are testament to the idea one cannot time the market. What’s ahead from here? There are reasons to offer regarding a correction; and reasons to offer for more gains. The market is without a 5% pullback for over 8 months which is unusual; it is normal to experience a correction (-10% drawdown) in bull market advances, occurring several times during the average bull market run (of 5 years). As for further advance and more gains – the Fed is preparing to slowly conclude (taper) of its QE policy that buys bonds in the market, because the economy is showing strength to stand on its own two feet; the Fed is not ready to start raising interest rates yet (meaning two separate transitional actions). The economic backdrop is important – by all statistics, it is recovering and advancing. That supports further stock market appreciation, but at a slower pace. We are watchful of sticky inflation, significant tax policy changes, and Fed action that raises interest rates too fast. These together would alter the current economic backdrop – changing the price – for the new bull market.

Printer-Friendly PDF Version, including index and portfolio objective figures.

Bill Henderly, CFA | Nvest Wealth Strategies

September 3, 2021